|

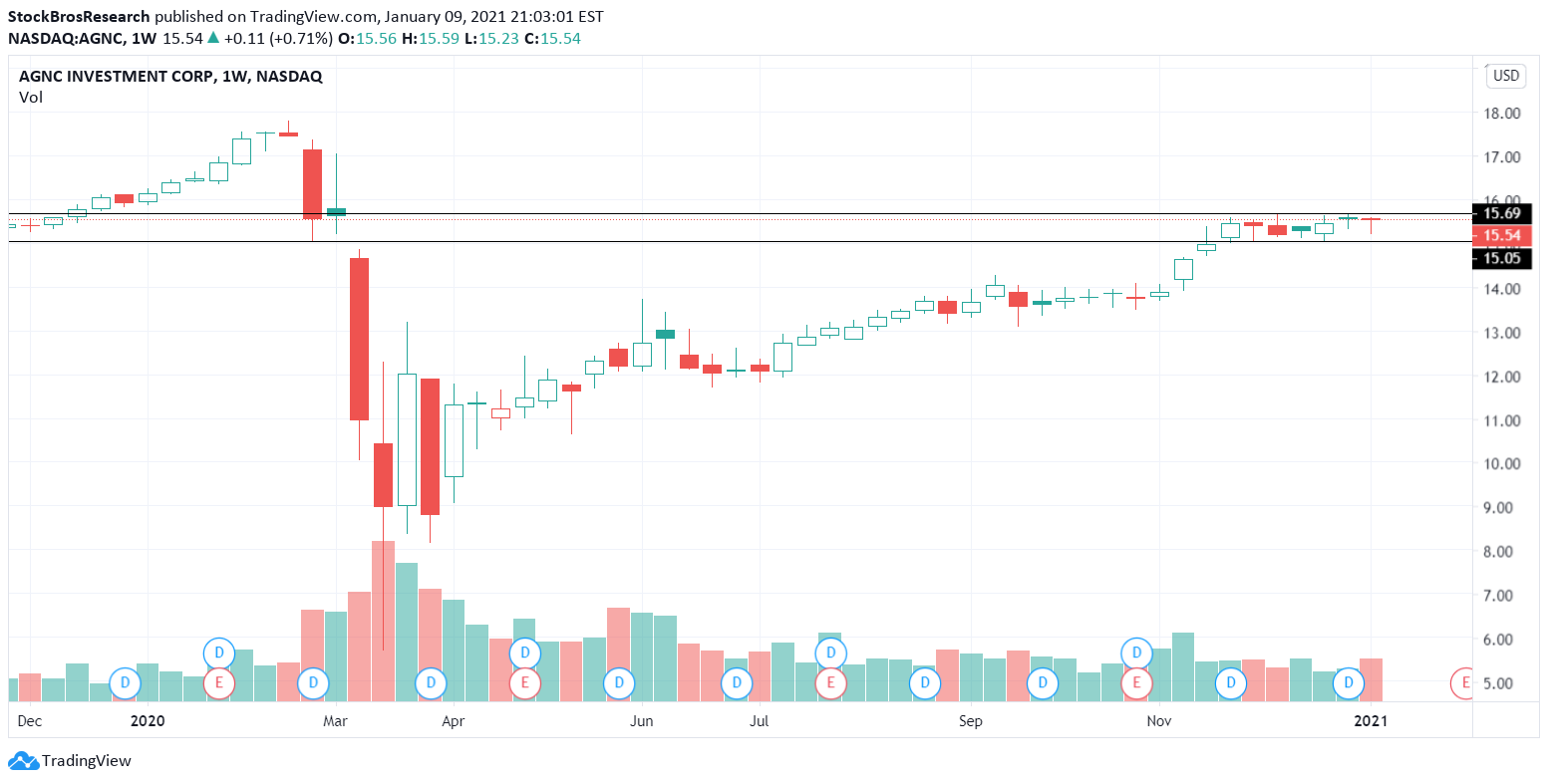

Here's this weeks' stock watchlist. The stocks to watch this week are: MWK, UUUU, RMD, ABBV, AGNC, ALB, SOLO, SBUX, DIS, XL, HD, and HE. 1. Mohawk Group (MWK)A very strong name with strong volume. This likely has more upside but it might be easier to buy the dips near the 9 EMA (orange line) until the trend breaks. 2. Energy Fuels (UUUU)Looking for a simultaneous break out in price AND volume for a long position as both are showing the same pattern. Fresh highs or a retest of highs would be likely if that happened. 3. ResMed (RMD)Basing nicely. Buy near the base or on a break out. 219.30 and ~224 are resistance points. 4. AbbVie (ABBV)Weekly time frame. ABBV is approaching all-time highs so we're watching to see if it rejects or breaks through that level (on above average volume). 5. AGNC Investment Corp (AGNC)Another weekly chart. AGNC is in a tight range right now and it can break out soon. 6. Albemarle Corp (ALB)Very strong volume patterns. Look for a dip or consolidation near the EMA's for another move higher. A good candidate for the momentum strategy. 7. Electrameccanica (SOLO)After a big runup, SOLO has gone quiet. As usual, watching for a break out on increasing volume as this stock can move big if it gets going. 8. Starbucks (SBUX)SBUX holding the 20 EMA and curling higher again. Looks like it will make new highs. 9. Disney (DIS)DIS has been holding the 9 EMA strong this entire run up. Looking for that to continue. Long until the trend stops. 10. XL Fleet Corp (XL)Starting to curl higher, watching for a potential double bottom to form. No position/trade yet. 11. Home Depot (HD)HD constantly supporting the same zone around the low $260's. Range is getting tighter. On watch for either direction. 12. Hawaiian Electric (HE)Stock looks weak, just broke out of a range to the downside. First target could be just under $33. Stop loss would be above $35 for a short. Need Charting Software?A great charting platform that we would recommend for serious traders is Tradingview. We use it every day as it has many useful tools and is very customizable. There is also an active trading community where people from all over the world post their trade ideas, so you never run out of ideas. Sign up through this link to get up to $30 to put towards a plan of your choice (or get the free plan).

Thanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted! |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed