|

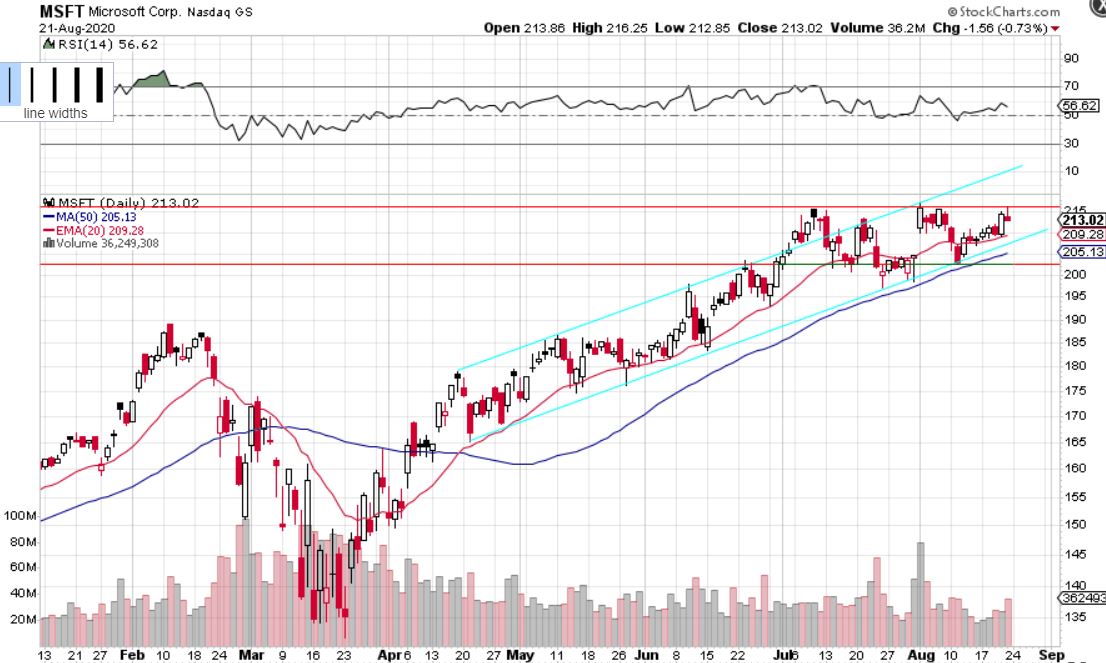

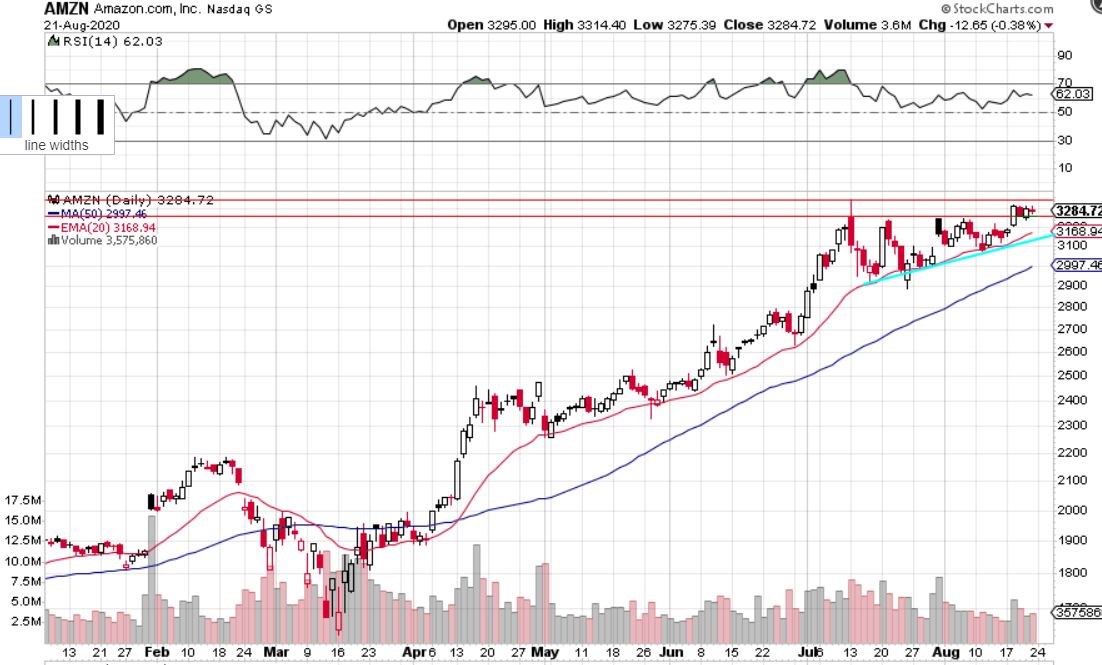

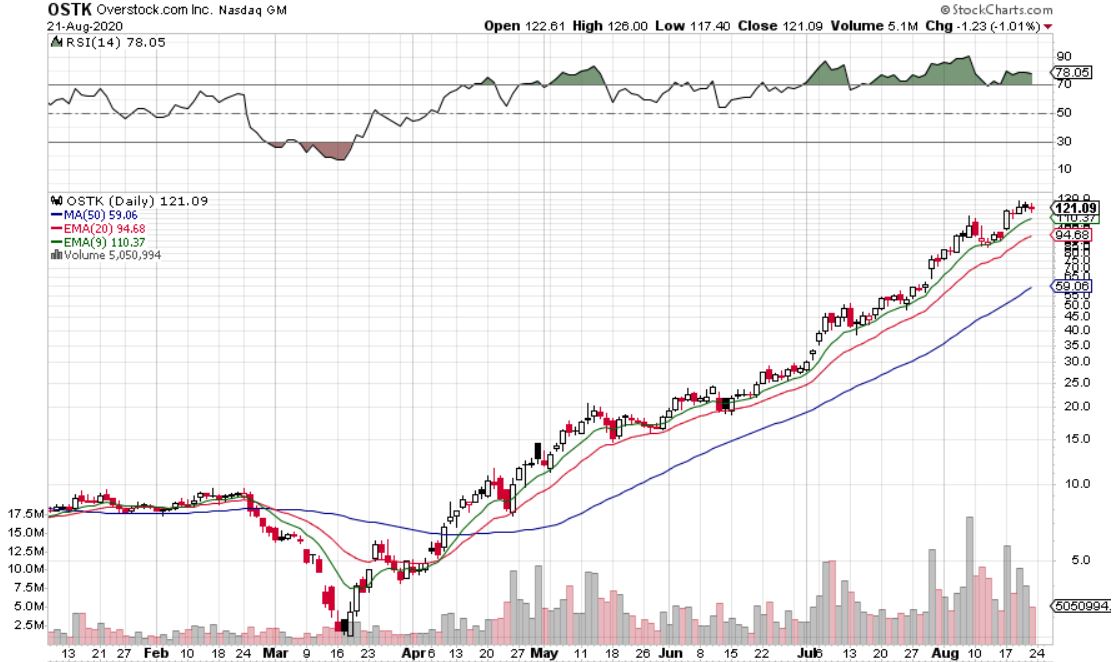

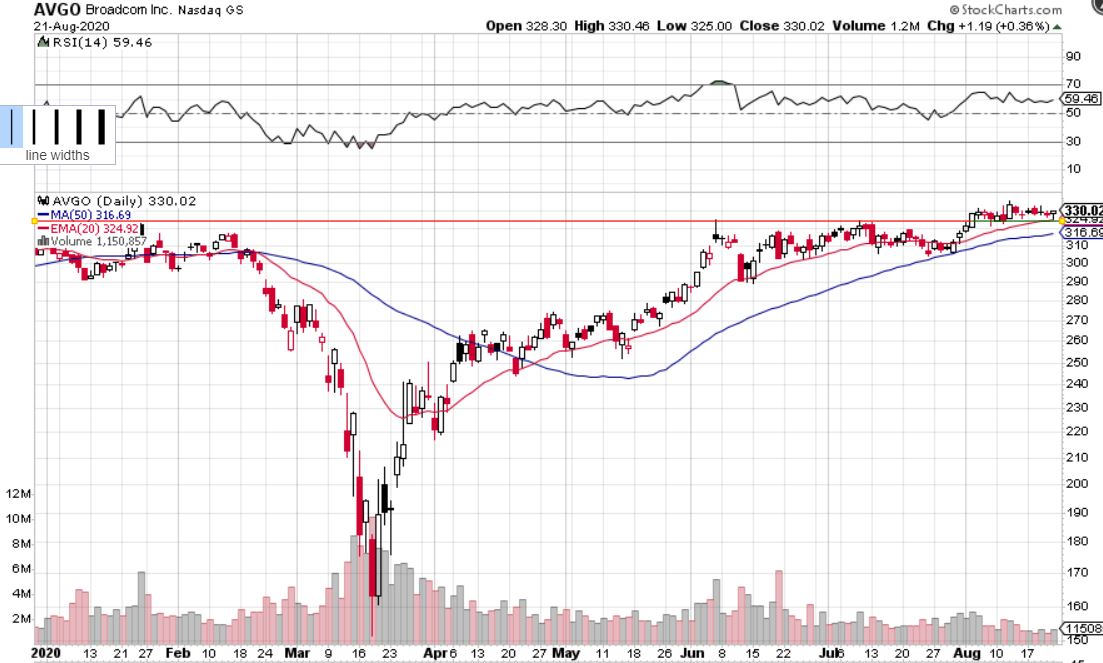

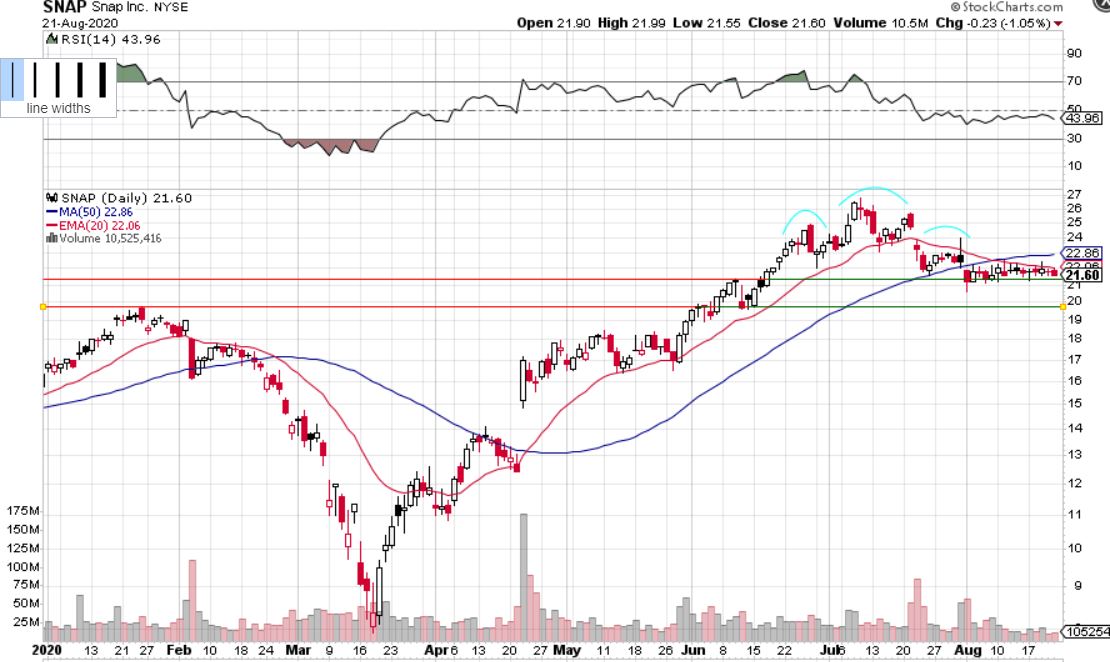

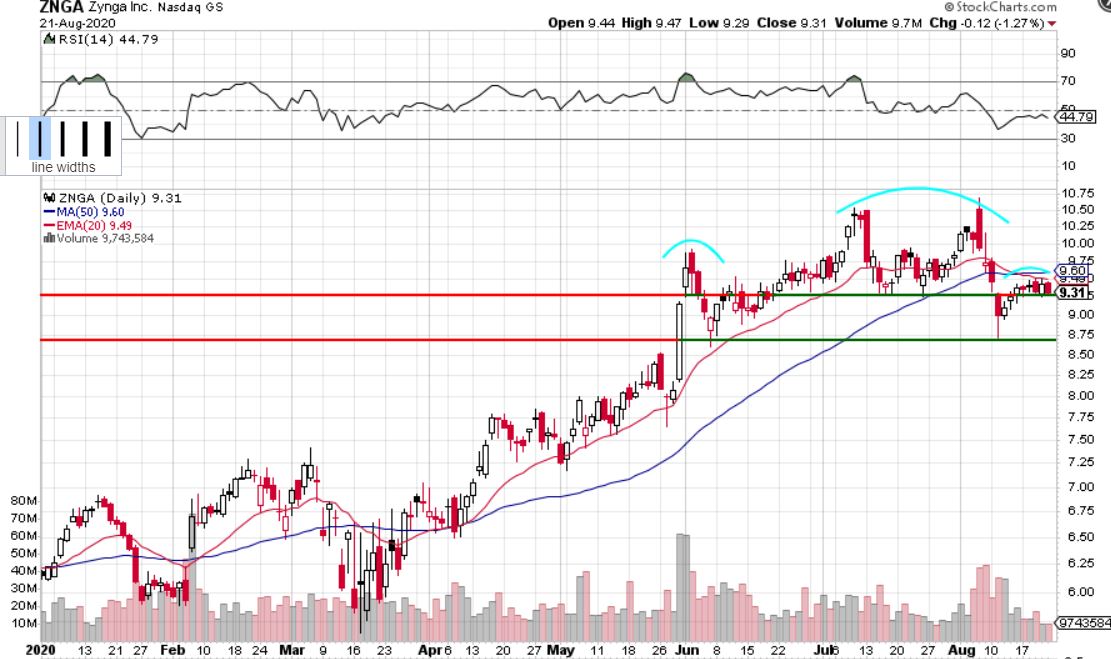

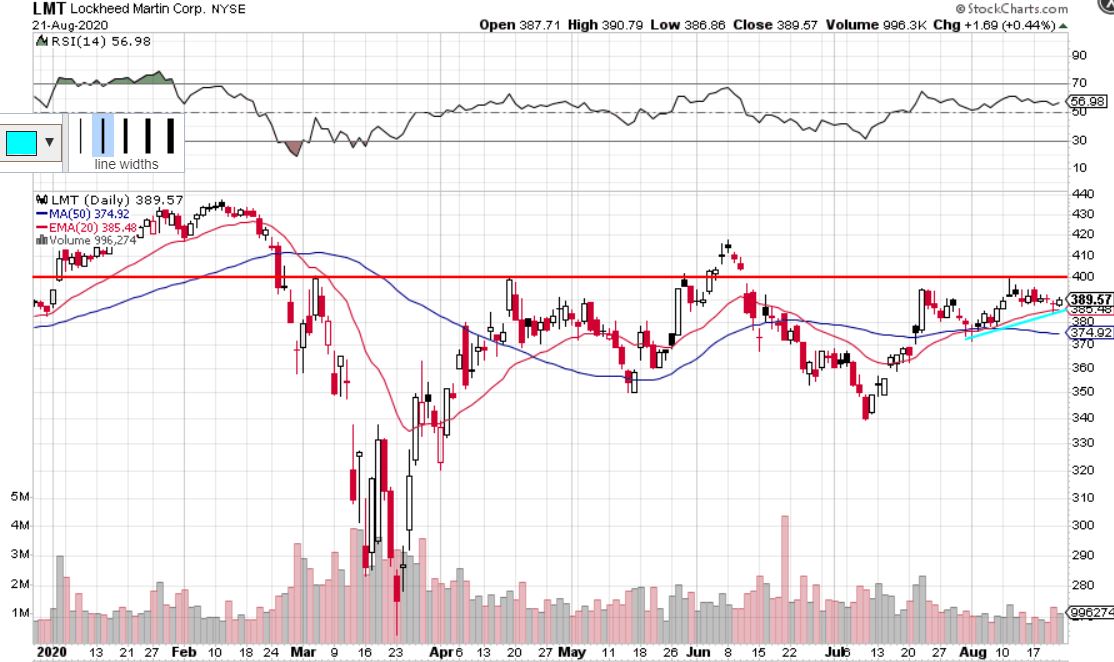

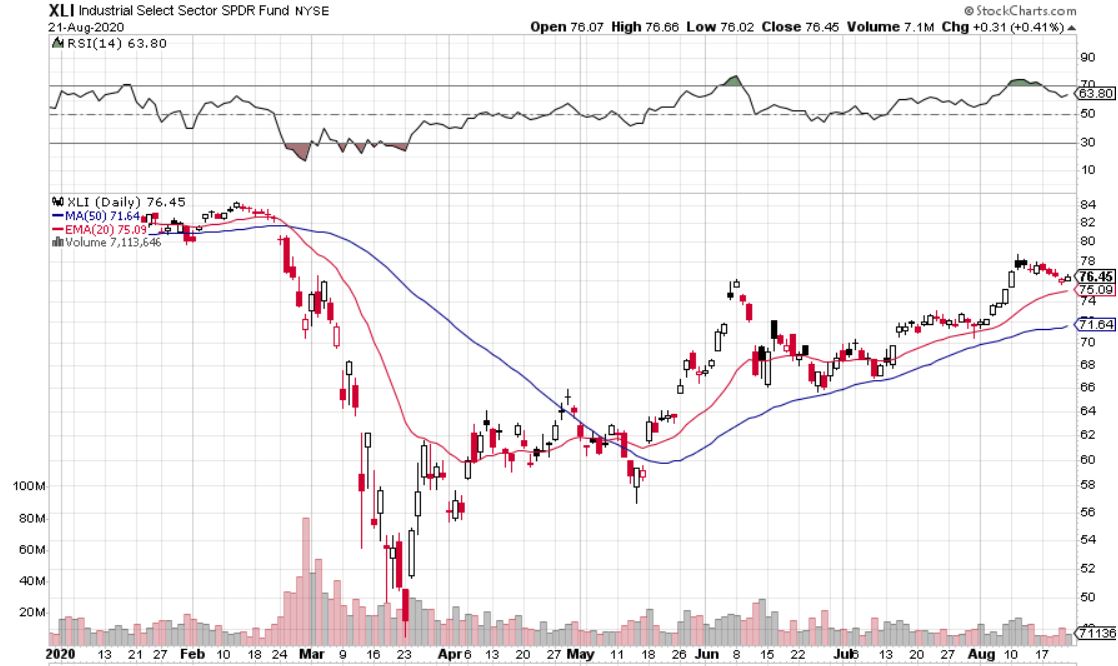

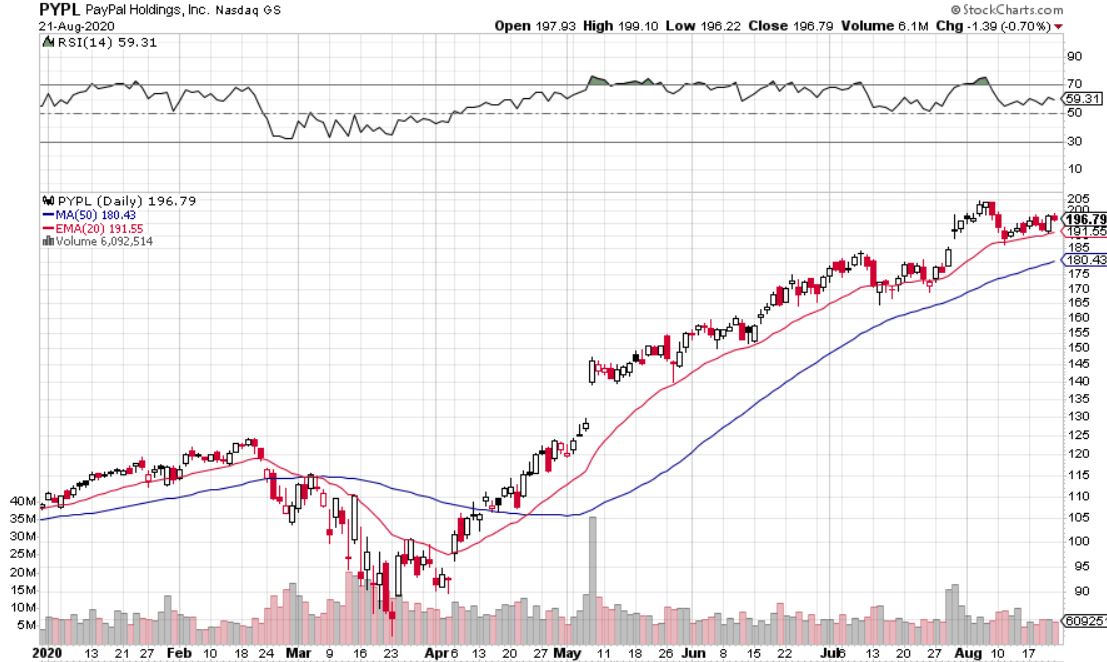

Here is this week's watchlist. 1. Microsoft (MSFT)A clear upwards channel in MSFT with a horizontal resistance above around $215. A few days of consolidation is ideal for a rip higher to a $230 price target. $210-212 is a good entry point with stop loss around $200. 2. Amazon (AMZN)Amazon was on last week's watchlist as well and it acted according to plan. Now it is hanging around a horizontal resistance it broke last week and another resistance just above around $3340. If this can consolidate a few more days and let the 20 EMA catch up to current price, it would be a great entry. $3500-3600 is what we expect it to reach in short order. Near $3250 could be a good starting entry point. Hold position unless trend is broken. 3. Overstock (OSTK)Still bullish volume patterns in this monster stock. Volume on up days is almost always larger than down days. This was on our watchlist for the past 2 weeks and it has acted well. Look for a continuation of trend, meaning a pull back to 9 EMA (green line) and a rip higher. Even 20 EMA could support if 9 EMA fails. The plan is to follow that trend until it stops working. 4. Broadcom Inc. (AVGO)AVGO sitting on horizontal and 20 EMA support. Looks poised to move higher. 5. Tupperware Brands (TUP)A recent earnings winner with high short interest that is primed for a short squeeze. Support at $12 and $13, resistance at $15. If this breaks it can hit $17-20 easily. Currently long. 6. Home Depot, Inc. (HD)Home depot holding its trend. Recent engulfing candle near support is signaling further upside. 7. Snap Inc. (SNAP)SNAP still being weak relative to the market with its head and shoulders setup. It's hard to short stocks in this very bullish market so I'd only do this as a hedge. Same idea as last week. 8. Zynga (ZNGA)Very similar to SNAP (#7 on the list), same idea. 9. Dollarama (DOL.TO)Dollarama daily timeframe: A recent breakout on the daily timeframe. Looking for it to pull back, support, and go long. Dollarama weekly timeframe: Dollarama's daily time frame breakout is also met by a weekly time frame breakout. DOL.TO has been forming an inverse head and shoulders for 2 years so this should be a good breakout. 10. Lockheed Martin (LMT)A break of $400 leaves room for it to go near $420. Currently near a support level and it seems that it wants to go higher. 11. Industrial Sector ETF (XLI)It may be too early to say, but XLI might have found support at current price. A few days hovering around here would confirm that, and would be great for a long to $80+. 12. Paypal (PYPL)Paypal usually supports around 20 EMA so I don't expect it to be different this time. Nice engulfing candle printed recently too. $192-193 are good entry points. Stop loss under $185 if you want to give a lot of room. If not, under $190 is good. Resistance around $200 for now. Upside target if it breaks out is $225. 13. United Parcel Service (UPS)UPS is consolidating in a tight range right now. A buy near the lower end of the range is ideal. Still looks bullish.

|

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed