|

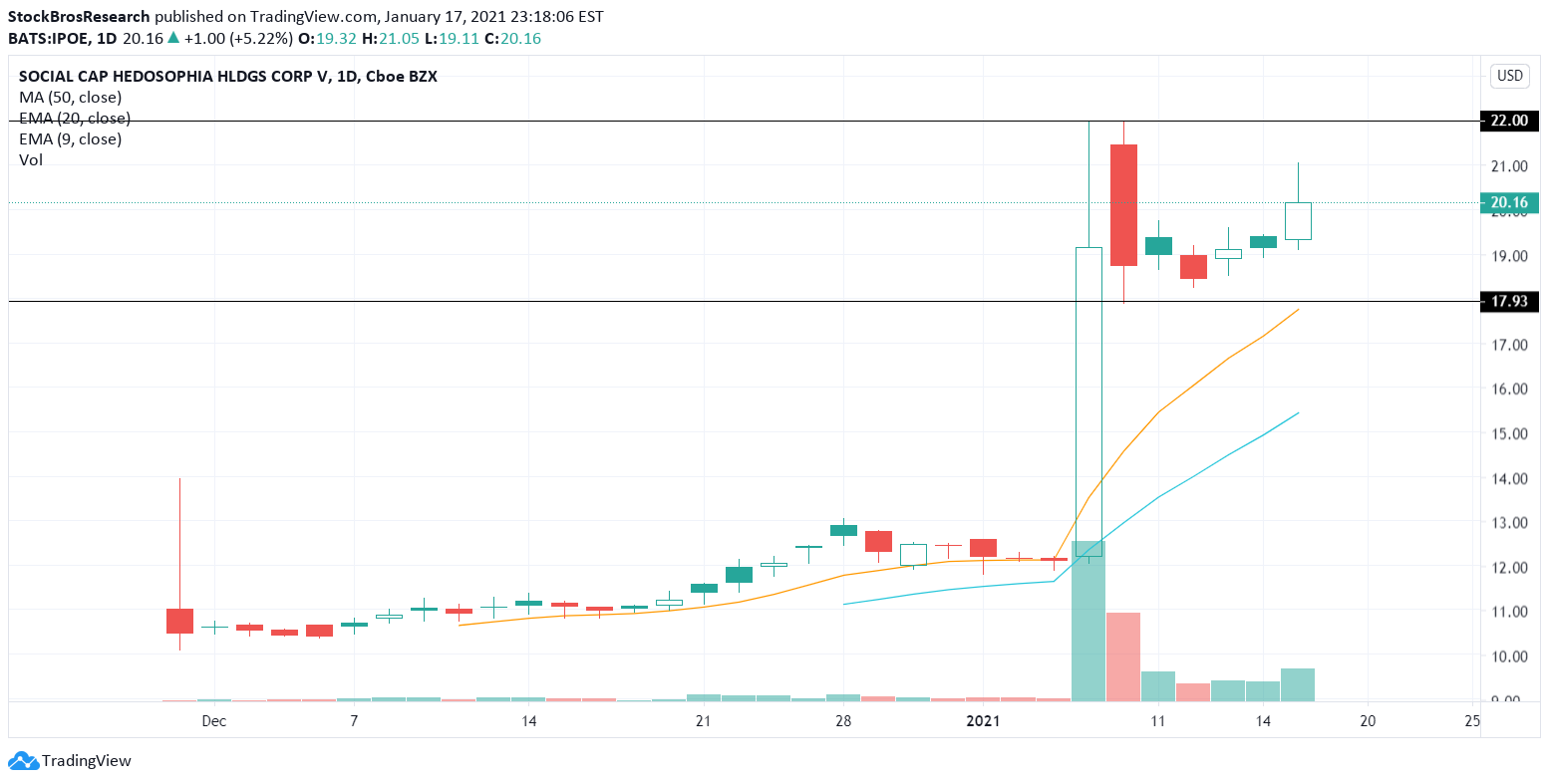

Here's this weeks' stock watch list. The stocks to watch are: ALGN, AVTR, RVLV, GTLS, IPOE, ALB, AGNC, SAIL, TRUP, ONEM, XL, FROG, BRP, FSR, PG, WELL.TO, STPK, and LGVW. 1. Align Tech (ALGN)ALGN appears to be starting another move higher after supporting previous resistance around $540. ALGN can hit around $600. 2. Avantor (AVTR)Nice hammer candle with a slight volume jump compared to the previous day. This stock has respected reversal candles in the past so it might be good for a long (stop under the hammer wick). 3. Revolve Group (RVLV)Strong name recently has been hovering above the 9 EMA (orange line) so buys around that area could be good until the trend reverses. 4. Chart Industries (GTLS)Consolidating right now but the stock is strong so keeping an eye on it for another move higher potentially. 5. Social Capital SPAC (IPOE)$22 is a strong resistance level that got tested twice on high volume (you can see this better on an intra-day chart). Watching for a break of $22 or a nice multi-day or week consolidation for a long entry. 6. Albemarle Corp (ALB)Nice volume patterns indicating that the stock is bullish (high relative volume on green days). Stock may not be ready to jump just yet but, on watch. 7. AGNC Investment Co. (AGNC)From last weeks' watchlist. Still waiting on a break out but it's getting close. 8. Sailpoint Tech (SAIL)Another strong name. Resistance near $59.50. Would like to see a volatility contraction followed by a break out. Would enter a long if a new base if formed (first green semi-circle). 9. Trupanion (TRUP)Double bottomed near $112 but double topped near $125. Either play the range or wait for a break out. 10. 1Life Healthcare (ONEM)Looks like its starting to curl higher off of the 20 EMA. No position as it may be too early to call. 11. XL Fleet (XL)If support near $19.73 breaks, it can quickly go down to around $18.85. But this can also end up bouncing off the $20 support so we're open-minded to trade it either direction. 12. JFROG Ltd. (FROG)JFROG break down. Support levels listed on chart. ~$59.07 and ~57.27. 13. BRP Inc. (BRP)BRP is repeating a familiar pattern from August which sparked a multi-week rally. Expecting possibly the same thing to happen again. 14. Fisker Inc (FSR)Watching for a break out in either direction here. Levels listed on chart. 15. Procter & Gamble (PG)Nasty head and shoulder set up but it hasn't broken down just yet. On watch. 16. WellHealth (WELL.TO)Canadian ticker. Looking for a push above the $7.93 area for the next leg higher or another retest of $8.50. 17. Star Peak Energy (STPK)Renewable energy SPAC, what else is new? Volume dried up on this pull back which is bullish. Look for momentum to shift back in just as it did 2 weeks ago and then buy it up. 18. LongView Acquisition Co. (LGVW)Another hot spac name that's been consolidating for a bit. Ideally would want more low volume consolidation and then a rip higher but let's see. Currently wouldn't be interested if it breaks under $19. Need Charting Software?A great charting platform that we would recommend for serious traders is Tradingview. We use it every day as it has many useful tools and is very customizable. There is also an active trading community where people from all over the world post their trade ideas, so you never run out of ideas. Sign up through this link to get up to $30 to put towards a plan of your choice (or get the free plan). Thanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted! Related Topic |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed