|

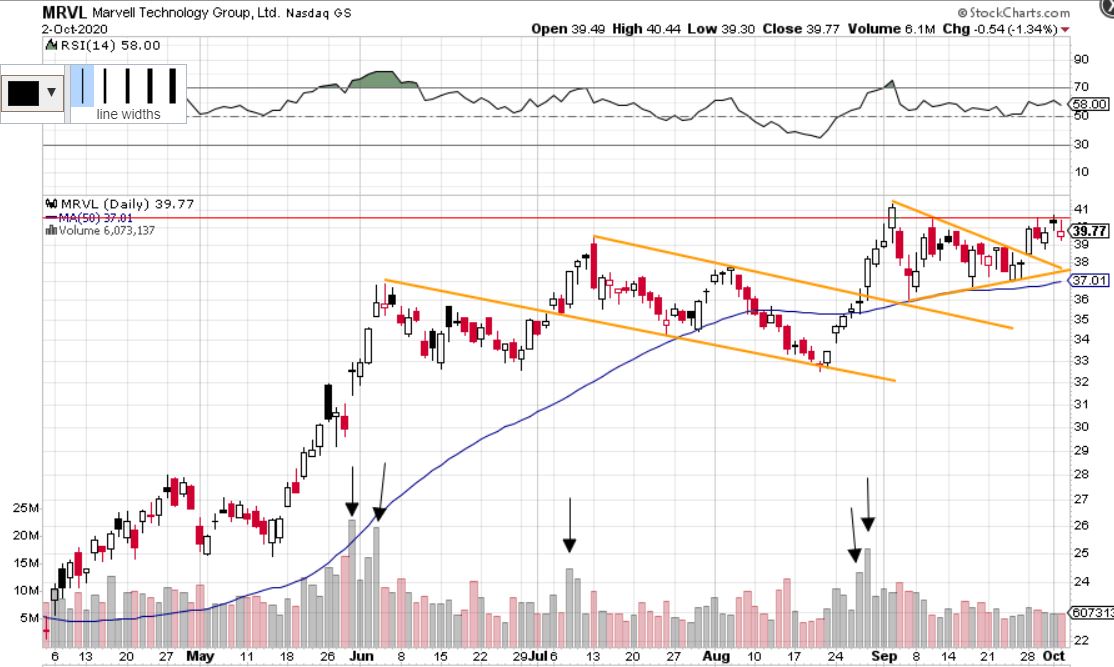

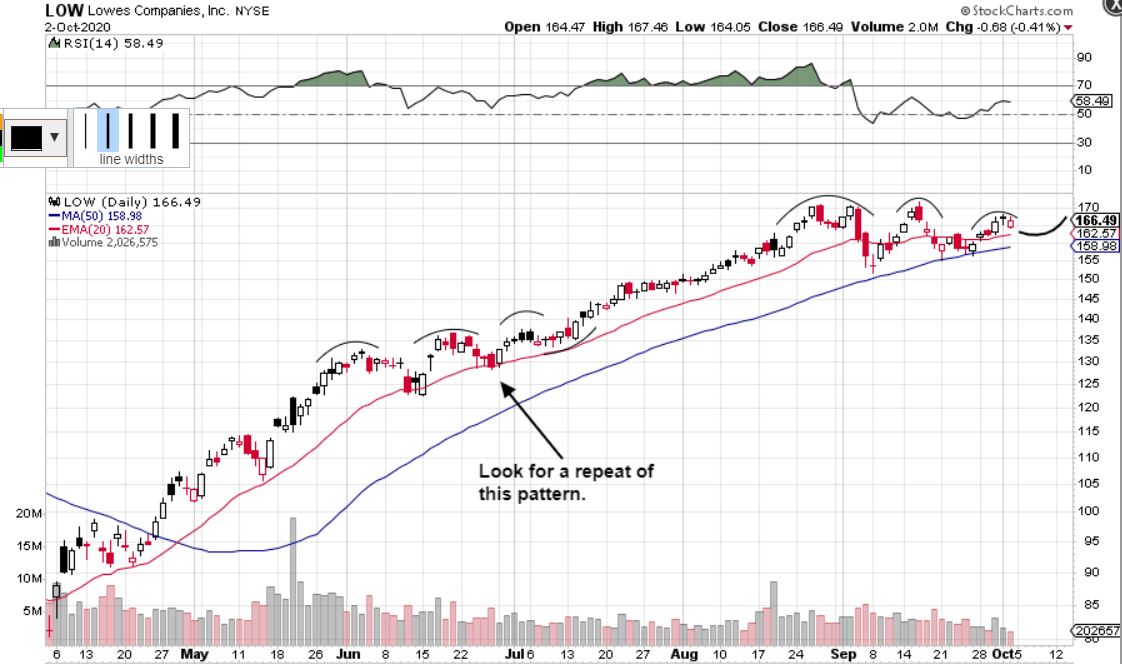

Here is this week's stock watch list. This week, we will take a look at AVGO, MRVL, LOW, TUP, ZM, REGN, APPS, PACB, and LEN. These trade ideas are mainly meant for swing trading. 1. Broadcom (AVGO)Broadcom looks like it could repeat what it did back in late July/August and break out sometime soon. Support at the 350 area, resistance at 370 area. Let's see if it holds the trend line it is currently sitting at. Overall bullish. 2. Marvell Technology (MRVL)Similar chart to Broadcom above. Same idea, except this one has bullish volume patterns supporting it so it may be even higher odds. Overall bullish, but wouldn't be buying around $40 unless it can hold this level for a few days. 3. Lowes Companies (LOW)Look left to June/July. The same pattern may be emerging. Looking to buy if it can hold 20 EMA (red line) for a few days. 4. Tupperware Brands (TUP)This can get bullish again if it reclaims the the 20 EMA by closing over it, specifically if it does so on high volume. 5. Zoom Video Communications (ZM)Will be following our momentum swing trading strategy on this one. Looking to buy near the 9 EMA (green line) if it can hold. If trade setup happens, the stop loss would be somewhere under 460, target would be a retest of previous highs or new ATH. 6. Regeneron (REGN)Neutral bias on this stock, looking for a break out or break down, either or. 7. Digital Turbine (APPS)If it can retest and start to bounce off this trend line on the 65 min time frame, we will look to go long for a continuation of the up trend. 8. Pacific Biosciences (PACB)If this starts getting parabolic, it will be bearish eventually. What we are looking for however, is for a controlled pull back on low volume for a few days. We will be using our momentum strategy for this stock as well, looking for potential buys at the 9 EMA. 9. Lennar Corp (LEN)LEN broke out of its resistance at $80. We're looking to buy on a controlled pull back for a continuation play. Need Great Charting Software?A great charting platform that we would recommend for serious traders is Tradingview. We use it every day as it has many useful tools and is very customizable. There is also an active trading community where people from all over the world post their trade ideas, so you never run out of ideas. Sign up through this link to get up to $30 to put towards a plan of your choice (or get the free plan). Thanks for reading! If you enjoyed this watch list or found it useful, please consider following us on twitter and/or subscribing to our free newsletter. Happy trading! |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed