|

In this post, we break down diversification and how many stocks you need in your portfolio to be well rounded, based on real statistics. We also talk about the "Holy Grail" of investing, which has to do with diversification, of course.

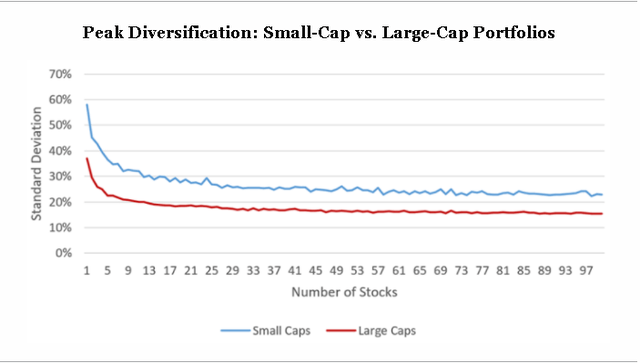

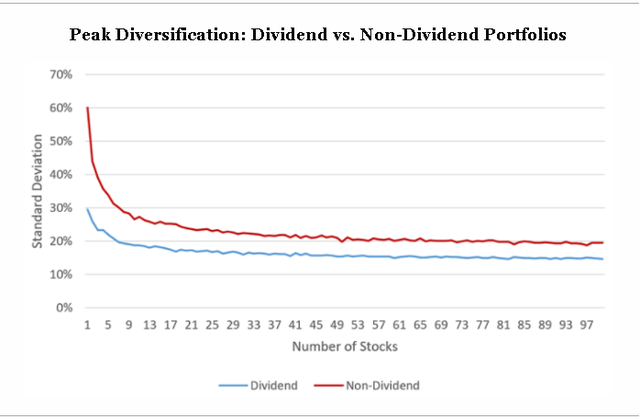

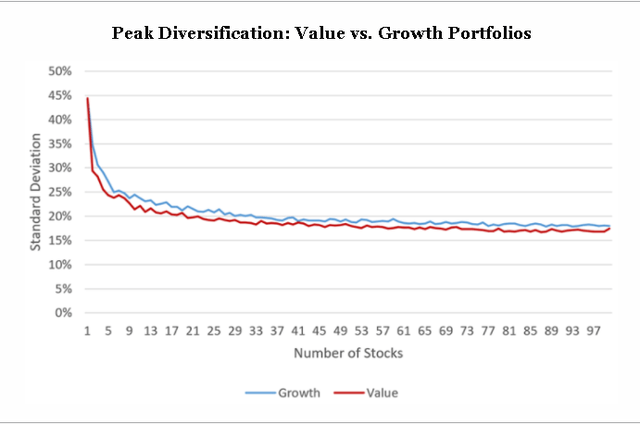

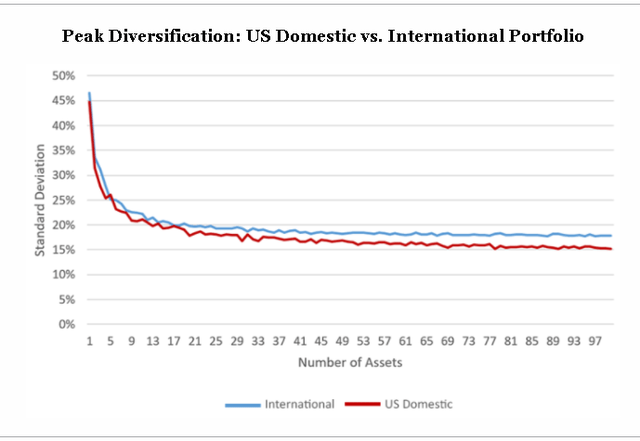

Different investors have different styles. Some investors prefer the relative safety of diversification while others look for concentrated bets with the aim of generating significant alpha. Alpha is defined as the excess returns earned on an investment above the benchmark return. One strategy is not necessarily better than the other because it depends on each investor's personality and skill level. For the average person, diversification is likely the better choice. However, for specialists with deep knowledge about a particular industry, a concentrated portfolio likely makes more sense. To be clear, a concentrated portfolio doesn't necessarily mean that all stocks have to be part of the same industry. It could also be one best stock from each sector. Nonetheless, we want to know how much diversification is actually needed in order to get as close as possible to a concentrated portfolio with most of the benefits of diversification. As it turns out, the answer is: it depends on portfolio style. The CFA Institute breaks it down into the following categories: small cap vs. large cap, value vs. growth, dividend vs. non-dividend, and US domestic vs. international. The results were as follows: Source for all pictures: CFA Institute For large-cap portfolios, there’s little to be gained by diversifying beyond 15 stocks or so. For small-cap portfolios, peak diversification is achieved with around 26 stocks. Overall, you could generally get away with about 30 or less different stocks in order to achieve most of the diversification benefits. However, we want to take this one step further. The results above were achieved with naïve diversification, which simply means that stocks are chosen at random without any consideration of underlying fundamentals or mathematical models. Ray Dalio, who manages the world's largest hedge fund, adds an interesting twist that he calls "The Holy Grail" of investing. He summarizes it nicely in the video below. To summarize the video from Ray Dalio, once you factor in the correlation between the individual assets in your portfolio, the number needed to achieve peak diversification decreases. In essence, if you can find 15-20 uncorrelated return streams, then you have basically achieved peak diversification. This is easier said than done thanks to ETFs passively buying and selling a large number of different stocks in addition to many institutional investors who basically just copy each other's moves. It's also important to note that Ray Dalio is referring to return streams, meaning any asset class, not just stocks. Nonetheless, the underlying principle still applies to a portfolio of just stocks. The takeaway from this article is that an optimally diversified portfolio should have as little correlation as possible. This allows investors to achieve the benefits of diversification while remaining as concentrated as possible. However, you shouldn't want stocks that are uncorrelated simply because the price drops while everything else goes up. You'd want stocks that are uncorrelated to the downside only, meaning they are less likely to drop simply because everything else dropped. To do this, we sometimes like to use downside beta because we believe it to be a better measure of risk (we will discuss downside beta in future articles). Improve Your Chances of Beating The MarketWant to improve your chances of beating the market? Check out our FREE Substack newsletter where we discuss stock market strategy, market updates, stocks to watch, research reports, and more.

|

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed