|

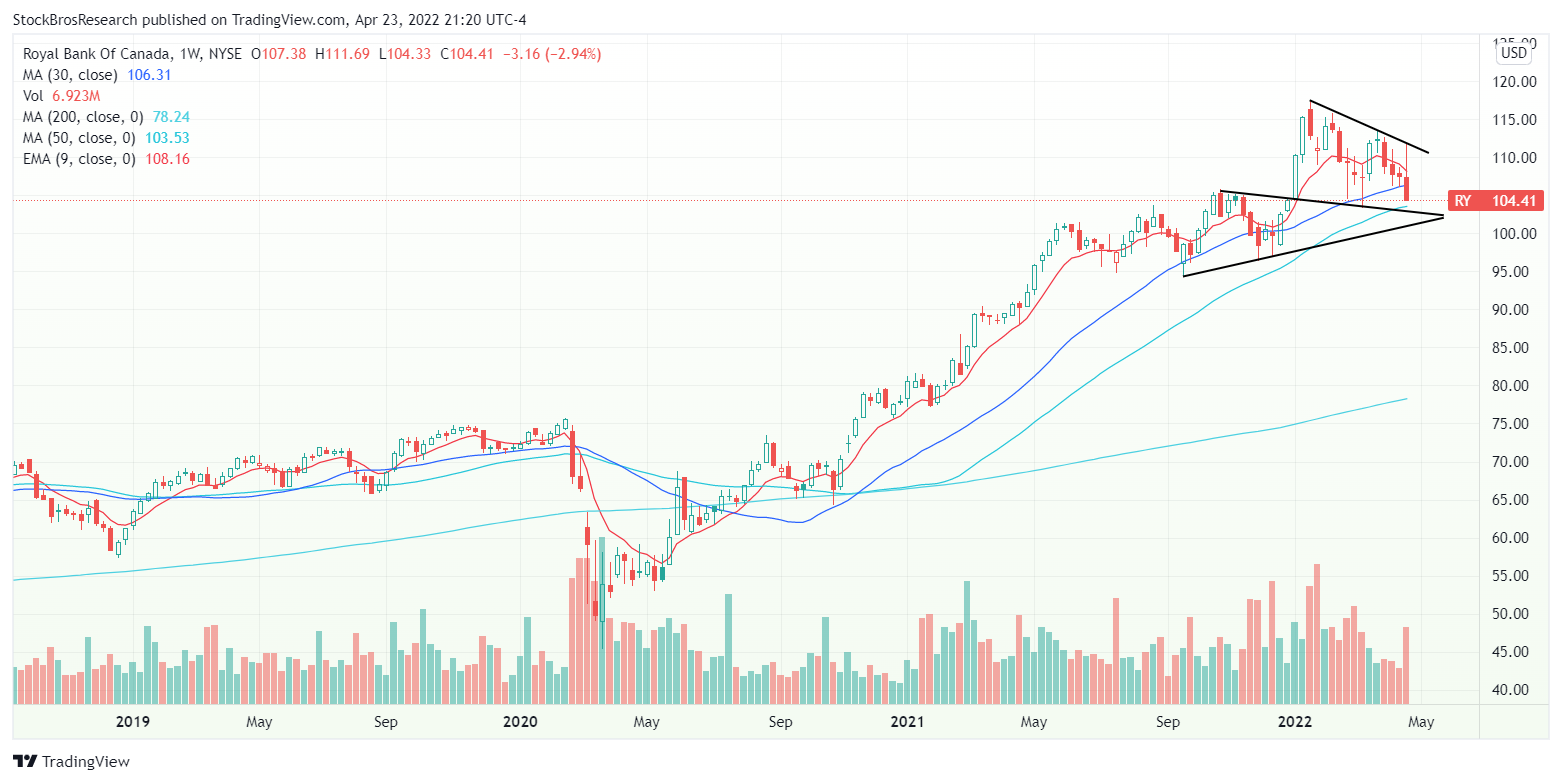

Hey everyone, We’ve been having trouble with sending emails this week for our bullish ratings, so here are a bunch of our recent buy ratings in one email, which are free to read. Besides the buy ratings, you should check out our JPM article from last week titled “Using JPMorgan's Earnings Call For Recession Clues” where we break down the biggest bank’s earnings to determine if a recession is coming soon or not. Note: This is NOT professional financial advice, do your own research before buying. Most of these Buy ratings are in downtrends, meaning that the chances for more short-term downside are high (as traders, we know this to be true). The ratings are not based on technical analysis. They are meant for long-term investors that have a long-term time frame. Anyways, here they are: 1. MDA to the Moon, Literally (TSX: MDA)MDA is an established Canadian space technology company with a long history of success and innovation. It’s been around for more than 50 years. We are bullish due to its successful history, high efficiency, and good valuation. It is roughly 50% off its all-time highs. 2. RH Stock: More Resilient than Investors ThinkRH, also known as Restoration Hardware, sells furniture, lighting, textiles, decor, and more. It has been beaten down as well, currently 57% off its highs. This offers a decent entry point for long-term investors. Read our article to find out why: 3. IIPR Stock: Sell Short at Your Own RiskInnovative Industrial Properties (IIPR) is a triple-net-lease cannabis REIT. Essentially, it makes money from owning cannabis properties and leasing them out to other cannabis companies. It is HIGHLY profitable and pays a nice, quickly- growing dividend. This stock has done very well historically, but now, it is about 45% off its highs. It got pushed down even lower by a short-seller report that is likely to not have much merit to it (similar to a 2020 short-seller report on the company). 4. Royal Bank of Canada: Does Valuation Outweigh Headwinds?Royal Bank of Canada (RY) is Canada’s largest bank in terms of market capitalization. We believe that big Canadian banks have competitive advantages due to the oligopoly they enjoy, and we believe that RY stock is undervalued. 5. Williams-Sonoma: Dividends, Buybacks Offer High Return PotentialWilliams-Sonoma (WSM) sells home products like furniture, bedding, lighting, rugs, and more. Currently 39% off its highs, we believe this is another good stock for the long term. Its low valuation allows the company to buy back many shares on top of having a respectable, growing dividend. It also has high returns on capital, steady growth, and record profit margins despite high inflation. Thanks for reading. Hope you found this article useful!

Be sure to check out simplywall.st, TipRanks, and Finbox for fundamental analysis, and TrendSpider for charting software! If you use our special link for simplywall.st, you will get a 14-day extended free trial and unlimited company views, meaning you can analyze all the stocks you want using their tools (which we use all the time). If there are any stocks/topics you’d like us to cover, hit us up! Email: [email protected] Twitter @StockBrosTrades |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed