|

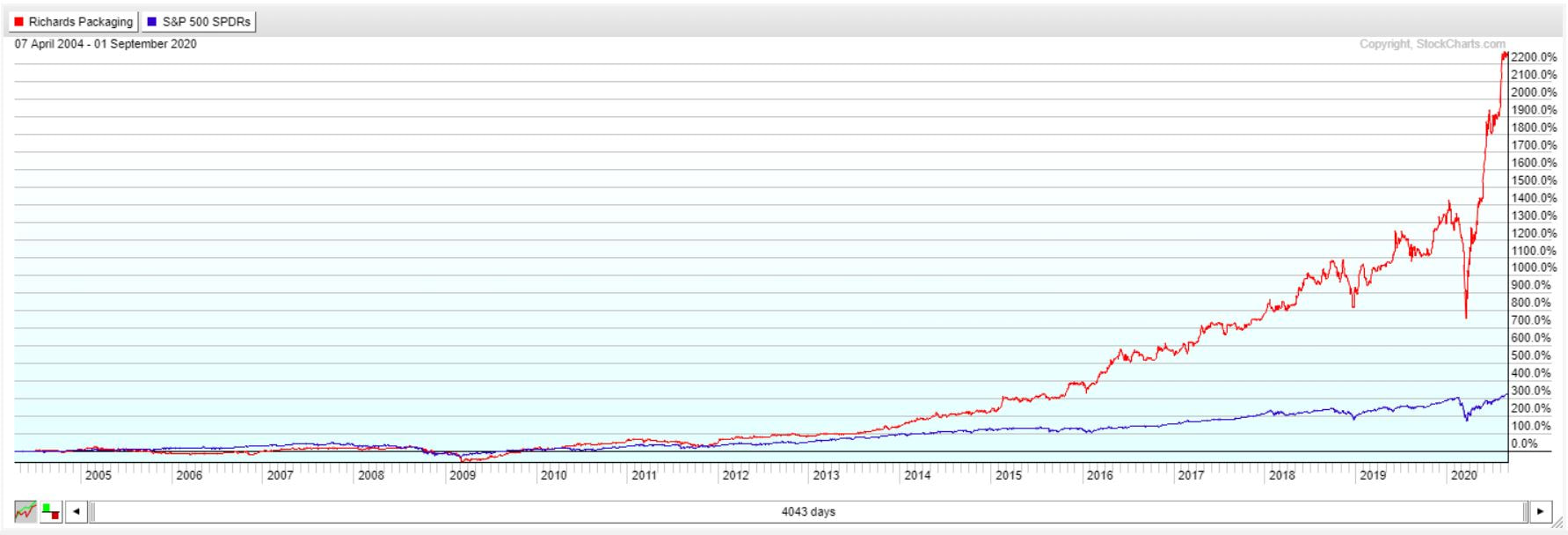

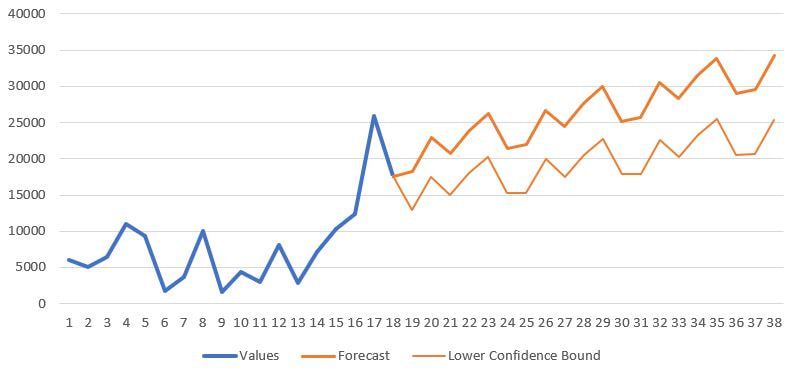

Richards Packaging Income Fund is a packaging company that has generated an average compounded annual return of 22% for the past 16 years. It manufactures and distributes packaging and related products in Canada and the US. It serves approximately regional cosmetic, healthcare, food, beverage, and other companies. The company was founded in 1912 and is headquartered in Mississauga, Canada. A Long-Term Track Record of Predictable Growth Let's start with the annual share price + dividend returns. As stated above, it has generated an average compounded annual return of 22% for the past 16 years (as far back as the chart goes). Below is a chart of RPI.UN (in red) long-term performance compared to the S&P 500 (in blue). Besides the amazing returns, let's talk about the company's fundamentals. The company is free-cash flow positive and pays a monthly dividend. This year, RPI.UN saw a big increase in demand for their services due to the coronavirus because they are in the business of healthcare packaging as well. Their revenue also increased because of a rising US dollar compared to CAD, which was also attributed to the recent stock market crash. We do not believe that COVID-19 will last forever, therefore we made adjustments in our valuation calculations that will see their sales/income/free-cash flow come down a bit in the near future and eventually continue to go up with time. 5-Year Quarterly Free-Cash Flow Forecast Below is our projection of the next 5 years of free-cash flow for the company. We used 4.5 years of free-cash flow data to make this projection. We believe that the lower orange line is the likely trajectory over the next 5 years, therefore, that is what we used to do our free-cash flow valuation. When computing the numbers (using an 8.84% discount rate), we arrive at a fair value of about $94.59 per share for the stock. It currently trades at about $76 per share, therefore, it is undervalued. A Monthly Dividend Stock, but is the Dividend Worth it? Richard's Packaging pays an annual dividend of $1.32 cents per share. This is currently a 1.73% yield. Over the past 10 years, the dividend has been growing by about 5.25% a year on average. The dividend is definitely sustainable based off of our calculations but if you are buying it SOLELY for the monthly dividend, the yield and growth rate isn't very high for this stock. This is a good stock for consistent growth + a dividend on top of the growth. Balance Sheet & Health of the Company Current Ratio: 1.28 - Good Quick ratio: 0.55 - Subpar Debt to Equity Ratio: 50.7% The company currently has $71,563,000 million dollars in debt, with almost $141,000,000 in equity. This means they are not over-leveraged and are in a good position to maintain their debt to equity levels due to their free-cash flow generation. RPI.UN's shareholder equity is increasing almost every year and debt has stayed relatively constant around a 40-60% debt to equity level. EBIT (earnings before interest and taxes) covers their interest payments about 24x over. Richards Packaging's balance sheet is not flawless (sub par quick ratio), but it isn't bad either. It shouldn't be a cause for concern considering their strong free cash flow and ability to meet interest payments. Verdict Richard's Packaging Income Fund is definitely a great company in our opinion that has been growing predictably, has generated great returns, and has benefited from the pandemic. We value it at $94.59 per share, making it undervalued. We believe the packaging industry is a safe and resilient industry over the long-term that will continue creating shareholder value. Follow us on twitter! @StockBrosTrades |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed