|

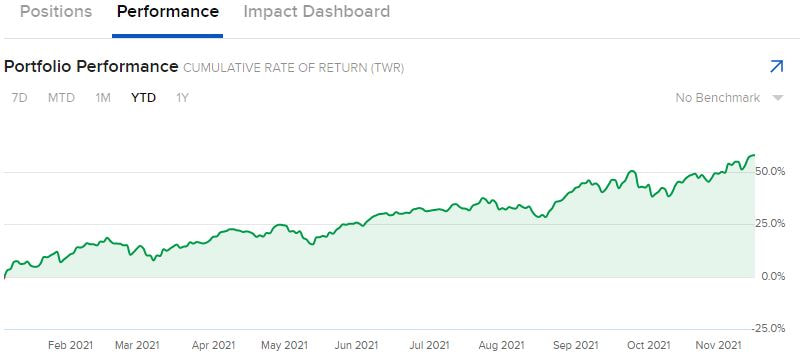

Hey everyone, it’s Vince and Andre. As you probably already know, we’re two brothers who talk about stocks. We’ve been investing since 2014 and have been through a lot of ups and downs. We’re currently bloggers for Seeking Alpha and TipRanks, and now Substack. We went from the beginner stages of falling for “hype” or “doomsday” predictions that got us nowhere, to where we are now; making money in stocks by following sound principles and doing research that most people are too lazy to do. We aren’t one-trick ponies either. Generally speaking, most investors classify themselves into one of three categories: fundamental analysts, technicians, and quants. However, we believe all three approaches are equally valid in their own ways and can complement each other when combined to create a better overall portfolio performance. What Kind of Stocks Do We Like and How Do We Invest?We mainly look at GARP (growth at a reasonable price) stocks, BUT we search for opportunities everywhere. As a rule of thumb though, we like companies with double-digit revenue growth, positive cash flow, high gross margins, and a competitive advantage. We prefer stocks to be either underfollowed or misunderstood because these businesses are likely to be mispriced, which presents opportunities for investors. However, we don't ignore well-known stocks and will make exceptions to our framework if we believe there is a compelling reason to do so. Companies with high gross margins have more money left over to reinvest in growth. Therefore, they are more likely to see high revenue growth while maintaining positive cash flows. Even if the cash flow margins are small, this could still be a sign that the company is growing responsibly and won’t have to rely on outside capital. We also focus on valuations. We don’t believe in buying stocks at whatever price unless it’s a short-term trade and we have a good reason to do so. We don't have a specified time horizon. We invest in a stock (or trade it) for as long as our thesis holds true and get out when the facts change. This allows us to be nimble and prevents us from staying wrong. It’s okay to be wrong. It’s not okay to STAY wrong. We’ve bought stocks with little to no revenue, as well as classic value stocks with low P/E ratios and revenue growth. Shares, buying options, selling options, complex options spreads; we just do what we think will make us money. In addition, we've developed market-beating algorithms with python that help us find attractive investment opportunities within our own portfolios. Sometimes we write research reports, like the ones we write on Seeking Alpha. When we do, we often dive deep into companies’ financial weeds to uncover hidden trends, suspicious metrics, and competitive advantages. We believe that in order for an investment narrative to be valid, it needs to be supported by the numbers. These numbers can come from financial statements, alternative data, key performance metrics, or independent market research. We also apply forensic accounting techniques to confirm if management narratives align with reality. If the fundamentals don't support expectations, then company projections become prone to disappointment, leading to large drawdowns. Although volatility is part of successful investing, companies with bad fundamentals recover much slower, if at all. Also, side note: a lot of what some investors may classify as "qualitative analysis" can in fact be supported by numbers. You simply need to know where to look and how to interpret them. Valuations are Important to UsWe do not value stocks with a "one size fits all" approach. Each company or industry faces a unique set of challenges and opportunities. Therefore, valuations need to be tailored to individual companies. For example, tech stocks spend a lot of money on research and development. The benefits from this spending are not realized right away. However, once these R&D investments do begin yielding results, the benefits can last for several years. Unfortunately, this does not show up on a balance sheet the way capital expenditures do. Therefore, adjustments need to be made to properly value these companies. Some examples of the different methods we use can be seen in the following articles: Our Recent PerformanceHere’s our year-to-date portfolio performance of around 57%, not bad so far. Currently, the S&P 500 is up about 28% or so this year. Hopefully, we can continue this performance going into the end of the year and next year, and also, we strive to help people achieve great returns as well! What You Can Expect From UsFor now, we are just testing the waters, but you can expect educational posts, interesting stocks to watch, market updates, some research reports, and more (potentially).

We hope you find our future content valuable! Good luck to everyone! Oh, and nothing we say is financial advice, of course. Just our opinions. Twitter: @StockBrosTrades Our Seeking Alpha Substack Newsletter |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed