|

VersaBank is a schedule I chartered bank in Canada with a branch-less business model. Its ticker is VB.TO on the TSX and VRRKF on the pink sheets. The company offers its services to businesses in specific niches rather than catering to individual people. VersaBank was founded in 1979 and is headquartered in London, Canada. They offer point-of-sale consumer financing, commercial mortgages, public sector financing, deposits, as well as innovative cyber security solutions for financial institutions through their subsidiary DRT Cyber. What Makes Versabank Great?Branch-less business model: This allows them to keep their costs down as there is less need to invest in physical infrastructure and people. Also, as everything is quickly shifting online due to COVID-19 and general conditions besides that, Versabank is in a good position for future growth. Net interest margins: Versabank has the highest net interest margins (3% margin) in the entire Canadian banking sector. Net interest margin is the difference of the amount of interest they receive for loans vs. the amount they pay out. This is an important metric for banks as they are lenders. Addressing Unmet Needs: *Taken from their investor presentation* "Canada’s insolvency professionals were being under-served by generic “big bank” offerings that did not integrate with their own systems, resulting in inefficiency and higher costs." Versabank realized that insolvency professionals were being under-served, therefore, they focused their efforts on going from 0 to over 100 insolvency partners in the last 7 years. Growth:

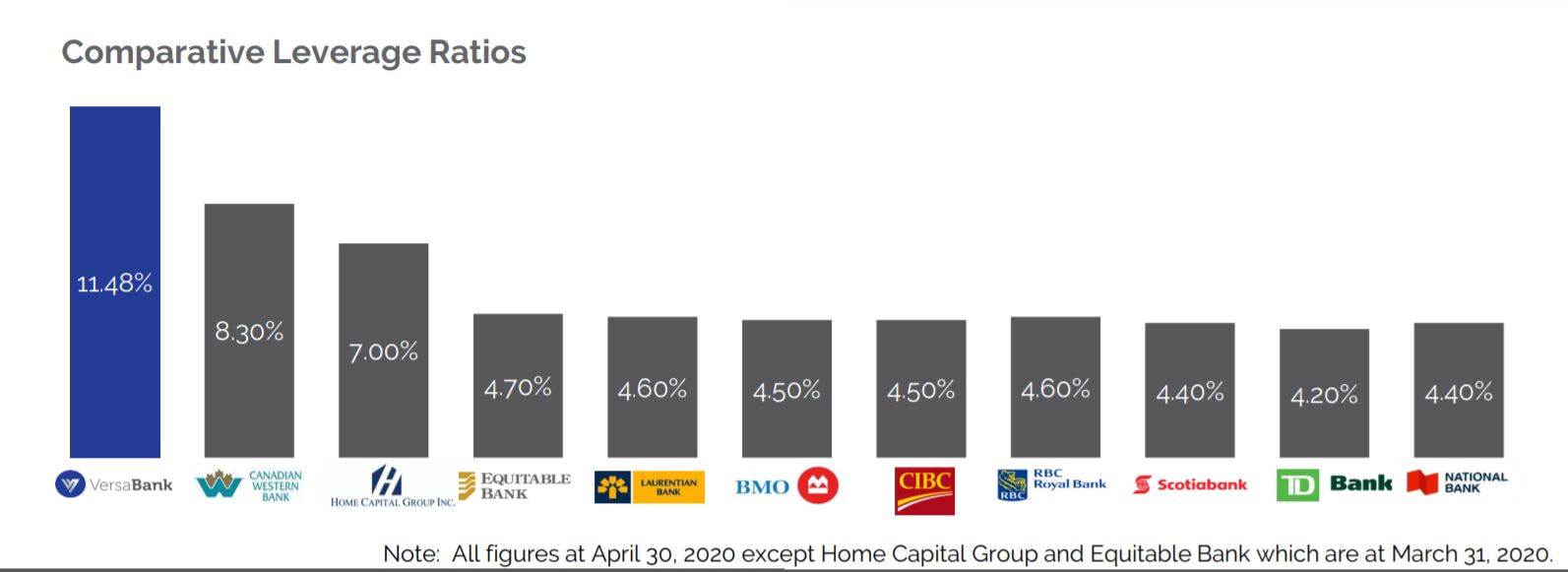

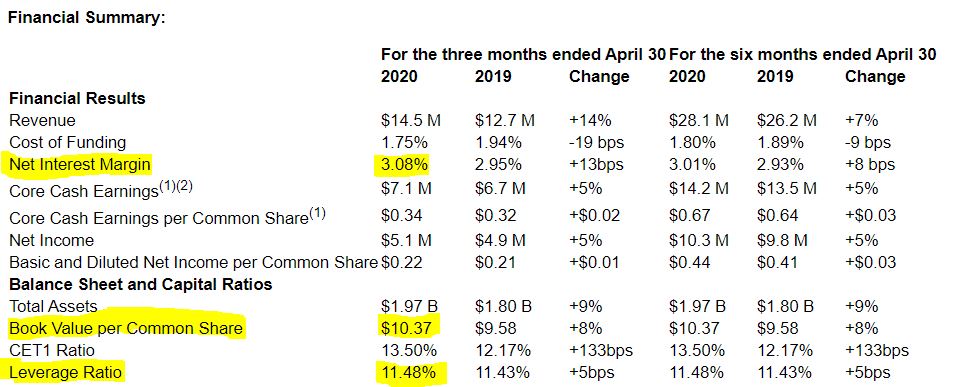

Financially Prudent Company: Versabank has a leverage ratio of 11.48%, which is the highest among its peers and is much higher than the leverage ratio of big banks. Essentially, the higher this number is, the less leveraged the bank is, meaning it has more capital. To give context, leverage ratio for the big banks are around 4-5%. Therefore, you can bet that Versabank is careful with how they use their capital. They currently have $2B available for deployment if needed. Great Value: Versabank has a book value per share of $10.37. The stock currently trades at around $7, making it very undervalued. Their book value will go up over time as long as they maintain their current profitability, meaning the $10.37 per share value will be higher in the future. Their book value grew 8% from 2019 to 2020 (see below). It's not only the book value of $10.37 making them undervalued. Their return on equity is 8.5%. With a proper discount rate of about 7% for the industry, they generate an excess return over their cost of capital. Excess returns add to the value of the stock which are calculated using the excess returns model, a popular valuation model for financial companies. We haven't done the calculations for the value of their excess returns as this is a quick overview of the company, but we know it would make the stock worth a bit more than $10.37. Nonetheless, ignoring the excess returns part, the stock is still undervalued based off its book value. Versabank's P/E ratio is currently 8.10. This is lower than the big banks who have P/E ratios around 10, making Versabank undervalued even when using this valuation method. Normally, we wouldn't pay much attention to P/E, as we like free cash flow better, but using earnings works better specifically for financial stocks. Ownership:

Verdict: If you are looking for a fully online, innovative company with growth potential for the future that ISN'T overvalued, Versabank may be a good bet. The company has a good track record of increasing earnings and the management team seems competent. This is a quick overview of the company, please do your own research before making a decision to buy. This is NOT financial advice. |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed