|

How valuable is the stock INMD? This post will offer InMode Ltd.’s fundamentals and catalysts to see if this stock is worth investing in. InMode Ltd. is a provider of minimal and non-invasive radio-frequency technology. Its innovative technology strives to improve surgical procedures. These commercialized products are used by plastic surgeons, gynecologists, dermatologists, and more. One of its FDA approved technologies is called Radiofrequency Assisted Lipolysis (RFAL). This technology contours the face and body without scarring. It allows for larger volumes to be treated with significant shrinkage of skin. Key Points

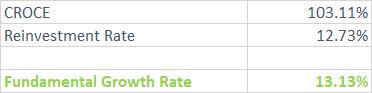

Stellar Balance Sheet InMode has no debt, which is always good to see. This allows them to weather the pandemic easily. They also have over $201,000,000 in cash, which is great considering that's 1/5th of their market cap. Total assets are $229,701,000 (about $225 million of these assets are current assets), liabilities are $34,868,000. As you can see, assets heavily outweigh liabilities, which is good. They also have low inventory requirements. Their current inventory is only worth 12 million dollars. Valuation - How much is INMD worth? To calculate INMD's valuation, we used a reverse discounted cash flow model (RDCF). Instead of forecasting the future cash flows of a company which can have many different variables that can be hard to forecast depending on the company, we figure out how much annual growth is required to sustain the current share price. We then figure out if the company can surpass that growth rate based off specific fundamental factors, which gives us our valuation. Using our calculations, we concluded that for INMD to maintain its $31.15 share price over the next 6 years, it must grow its free cash flow to the firm (FCFF) by 3.07% every year (we used a 10% discount rate and 2% perpetual growth after the 7th year which is conservative). We then calculated that its fundamental growth rate is 13.13%, meaning that it can grow by 13.13% each year. If 3.07% growth is required to sustain its current share price of 31.15, but it can grow at 13.13%, then that makes the intrinsic value of the stock $46.34 per share.

If using the expected CAGR of the industry of 9.8% as the growth rate, that would value the stock at $40.58 as a more conservative valuation. Average the 2 valuations together and you get an average intrinsic value of $43.46 per share compared to its current $31.15 share price. We believe that the growth rates that we used are reasonable and potentially conservative because the company has seen explosive growth in the past few years. For example, the most recent quarterly report had 49% YoY international revenue growth and 32% overall revenue growth (this includes the pandemic that partially affected the quarter). The company has been very much affected by the pandemic and is expecting lower numbers over the next few months, but we believe that when the pandemic is over, there will be a surge in demand that will make up for the temporary loss of demand, therefore justifying our 9.8% and 13.13% growth rates. Final Verdict: A growing company in a growing industry with a flawless balance sheet. As long as you, the investor, think that the company will grow by more than 3.07% a year, then it is undervalued. We believe that our estimates are conservative considering its past growth rate. INMD Very Conservative Valuation: $43.46 per share. Current Price: $31.15 per share. |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed