|

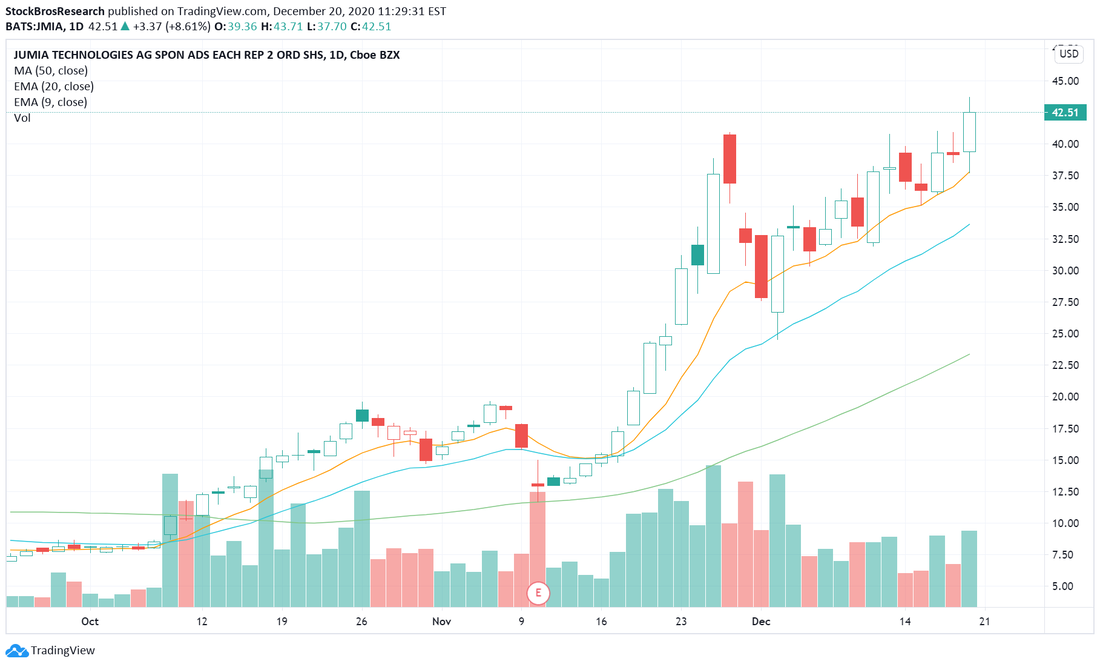

Here's this week's stock watch list. The stocks to watch this week are: NET, ORCL, REGI, NNDM, CAT, JMIA, PLTR, ROKU, SHOP, NIO, TSLA, XLF, WELL.TO, ATEX, and HD. Keep in mind that this is a shortened week because of Christmas, so happy holidays! 1. CloudFlare (NET)NET is making a move higher off of the 9 EMA as it has been doing since $60. Resistance just above, but a break out can lead to $90. Currently long, stop loss a bit under 9 EMA recent support. 2. Oracle Corp (ORCL)ORCL 65 min chart also bouncing off the 9 EMA, buy at that level until it stops working. 3. Renewable Energy Group (REGI)A nice break out from our watch list last week. Likely heading near $80, stop loss would be under the most recent days' low. 4. Nano Dimension (NNDM)Volume picking up on this move higher, expecting it to get close to $8 again. 5. CaterPillar (CAT)This was on our watch list for the past 2 weeks and it now looks ready to pop. Stop loss under 176, can head to around $190. 6. Jumia Technologies (JMIA)Supporting the 9 EMA recently. On watch for dips near that area, no position currently. 7. Palantir (PLTR)Forming a base near $25, this can get interesting in this hot market. Wouldn't be surprised to see it back near $34 or higher if it can hold $25. 8. Roku Inc. (ROKU)Very overbought, but another stock holding the 9 EMA. 9. Shopify Inc. (SHOP)SHOP broke out of a multi-month range last week. A retest and support around the $1150 would be good confirmation for a move higher (preferably) but it can keep going up regardless of a retest. 10. Nio Inc. (NIO)Broke out of a triangle last week and now it met its next resistance around $48.60. After $48.60 ish, it could be clear skies up until its previous highs. 11. Financial Stocks ETF (XLF)News came out late on Friday that the Fed is allowing banks to start buying back their stocks again. This caused bank stocks to go up after hours so it will be interesting to see how it plays out on Monday. No position for now. 12. Well Health Tech (WELL.TO)Nice move higher from Well Health on decent volume. On watch. Potential Short Setups13. Anterix (ATEX)Overall weak stock that has bounced very unconvincingly from it's previous low. A retest of that low is likely since it's currently on a downtrend. 14. Home Depot (HD)Rejection at the 50 MA and an engulfing candle on a lower high. This could have more downside. Stop loss for a short would be above Friday's high. 15. Tesla (TSLA)Tesla's chart is actually bullish since there was a break out on big volume. But, it gets added to the S&P 500 tomorrow (Monday) so this MAY cause a "sell the news" event since there was so much hype leading to the S&P 500 inclusion. Also, options premiums could get crushed too. What we expect is a gap up in the morning and then lower as the hype dies down, but this is a hard one to call and we'll play it by ear depending on how the market reacts tomorrow. No position so far, definitely not shorting unless it's an almost sure bet. Need Charting Software? A great charting platform that we would recommend for serious traders is Tradingview. We use it every day as it has many useful tools and is very customizable. There is also an active trading community where people from all over the world post their trade ideas, so you never run out of ideas. Sign up through this link to get up to $30 to put towards a plan of your choice (or get the free plan). Thanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted! |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed