|

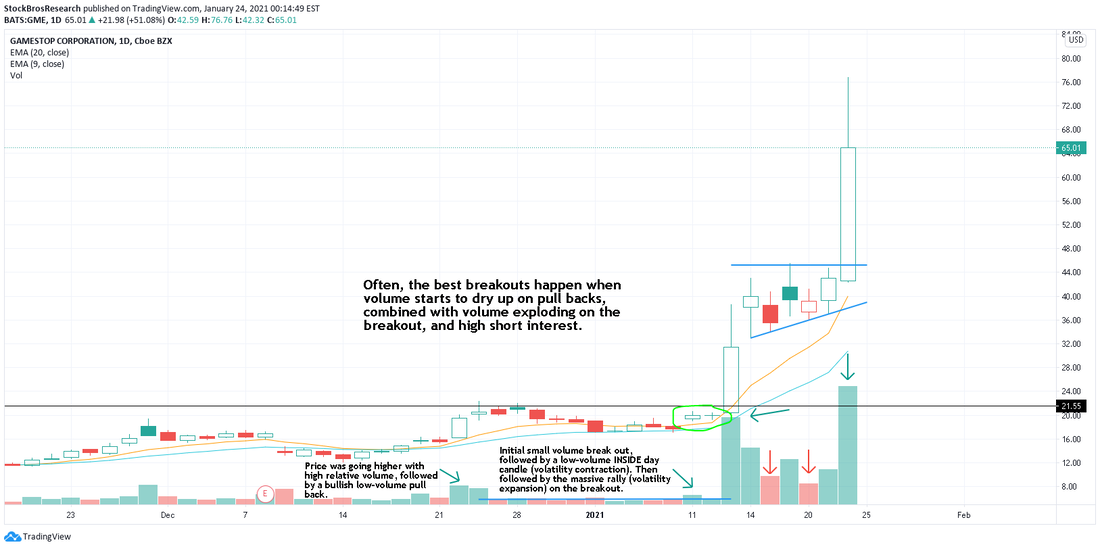

Here's this weeks' stock watchlist. The stocks to watch are SOLO, FUBO, FEYE, IDEX, GME, MAT, PLTR, DKNG, NIO, FRSX, GP, LAZR, VLDR, CGC, MSP, GDNP.V and GRN.V. 1.ElectraMeccanica (SOLO)SOLO broke out 2 weeks ago, and has since pulled back. The dip is being bought up though on good volume which is bullish. Closest resistance levels are near $8.50, $9, and $9.25. After that, there's no major resistance until the highs. Currently long SOLO. Not interested if it starts breaking down under $7. 2. FuboTV (FUBO)Somewhat similar to the SOLO chart above. Higher lows being set, and ascending trendline support. Arrows drawn on chart don't have to play out exactly, but that's the ideal scenario for us. Resistance around $41 area. A few days of consolidation can provide a buying opportunity. 3. FireEye (FEYE)Classic ABCD pattern is forming here. Notes outlined in the chart. Stops can be under C ($21.60 ish) or under B ($20.80 ish). Target is D, which is ideally new highs, but closest resistance points are $24.15 and $25.50. 4. Ideanomics (IDEX)Range getting tighter and volume patterns are bullish. Notes on chart. On watch for a break out. No position right now, currently at resistance. 5. GameStop (GME)Crazy short squeeze in GME with 260% of the float short and over 100% of shares outstanding (as of Dec 31, 2020, according to Yahoo Finance). In the chart below and in our How to Predict a Stock Short Squeeze article, we outline exactly what happened. This likely has more upside as short squeezes tend to get crazier and crazier, but just going to wait for the open tomorrow and try to join the trend if it squeezes again sometime this week. 6. Mattel Inc (MAT)Engulfing candle at the 20 EMA which has shown support before. This is a decent setup. The only problem is that there was no volume on the last runup, so momentum may potentially be drying up. It would be nice to see another break out with volume. Might be worth buying, especially if it consolidates around this level a bit. Stop would be under the $17.80 wick. 7. Palantir (PLTR)Tricky PLTR finally broke out after teasing for a while. Only resistance is ATH at $33.50. Going to play this one of 3 ways: 1. Try to anticipate a red to green move if it opens slightly down, and then sell into resistance or see if it breaks out. How to anticipate a red to green move. 2. If it opens between previous close and all-time highs (so somewhere between 32.50-33.50), we'll see if there's a quick morning dip (which shows support) to 32.50 zone, for a move to $33.50. Or see if it can break resistance right off the open on heavy volume. 3. If it gaps OVER $33.50, we'll look for dips near $33.50 to confirm that previous resistance turned into support. Then long if setup is there. 8. DraftKings (DKNG)As long as it holds the recent $50.70 support level, it could be good for a run up near the highs. On watch. 9. NIO Inc. (NIO)NIO breakout. If you can get a good long entry, stop loss would be good under $55.75. Target: New highs or retest of highs. 10. Foresight Auto (FRSX)FRSX has been repeating a familiar pattern of basing around the 9 EMA (orange line) before having massive volume push it up higher. Currently waiting for more of a dip/consolidation. Probably too early right now. 11. GreenPower Mtr. (GP)Nice cup & handle formation. Stop loss could be under $27.30 area, buying zone is between $28-30 or on a break out if you're a breakout trader. Low volume here looking great for a potential volume/price expansion. 12. Luminar Tech (LAZR)Very nice multi-week consolidation can provide a nice launchpad for this stock. Ideally a few more days to set a higher support base, but let's see what happens. Not interested under $28.30. Closest support is $29.40. 13. Velodyne (VLDR)Nothing for now, just staying familiar with the name. Triple bottom support around $21 area. 14. Canopy Growth (CGC)Good volume pattern, good consolidation. Looking for a break out on high volume. 15. Datto Holding Corp. (MSP)MSP is currently on a down trend and the recent bounce is starting to round out now, look for more short positions. 16. Good Natured Products (GDNP)Canadian penny stock. Support base around $0.80. Look for some green candles to come in around current price to get long. 17. GreenLane Ren. (GRN)Another canadian small cap. This has been riding the 9 EMA (orange line) nicely. Volume patterns are bullish. Look for buy zones and use the 9 EMA as a guideline. Need Chart Software?A great charting platform that we would recommend for serious traders is Tradingview. We use it every day as it has many useful tools and is very customizable. There is also an active trading community where people from all over the world post their trade ideas, so you never run out of ideas. Sign up through this link to get up to $30 to put towards a plan of your choice (or get the free plan). Thanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted! Related CategoryRelated Articles |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed