|

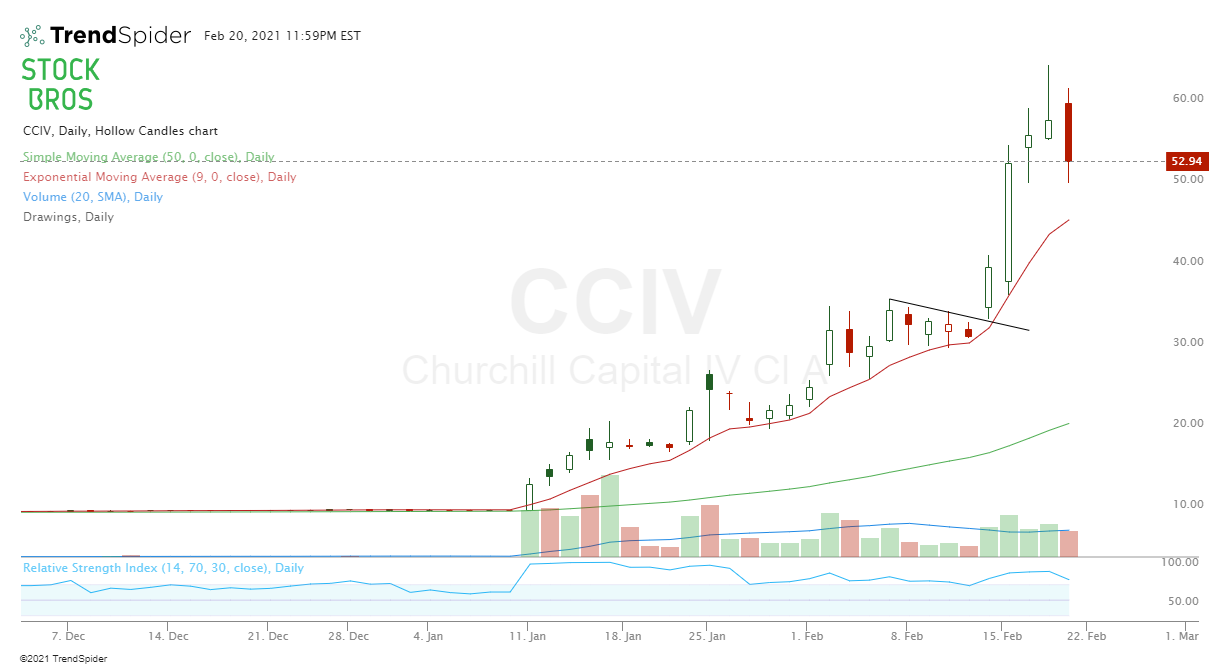

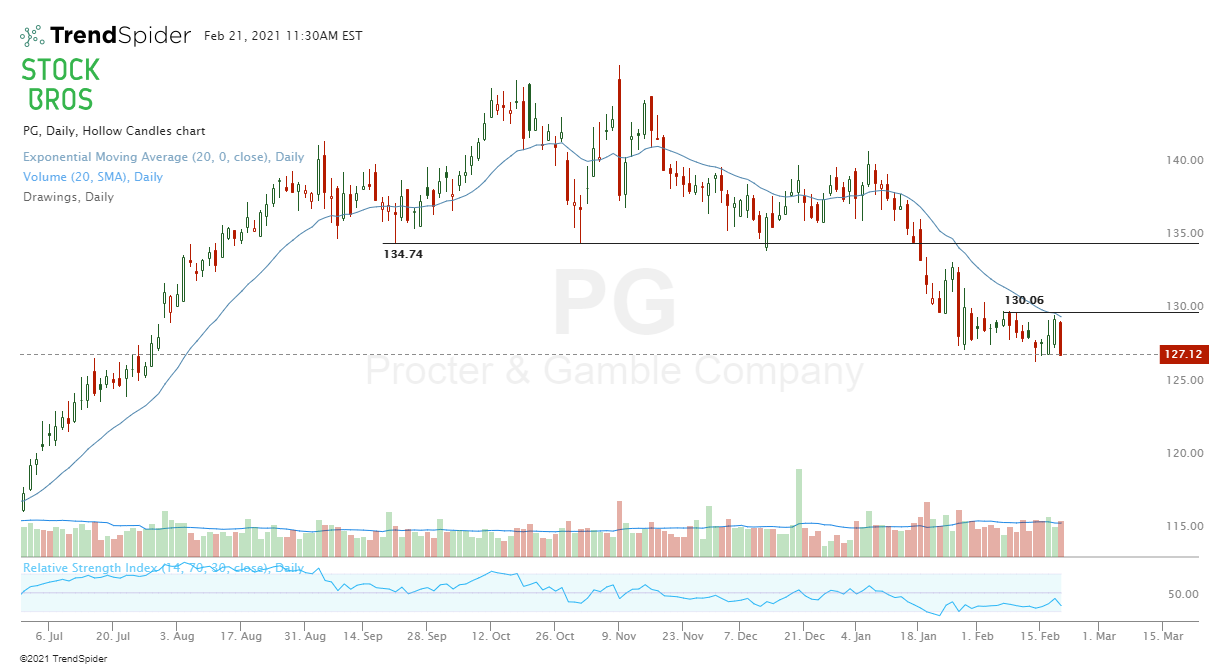

Here's this weeks' stock watch list. The stocks to watch are: FREQ, F, FUBO, CCIV, BEAM, SNAP, MNKD, RDFN, VRNT, LAZR, GSM, PAGS, SKLZ, NET, ARKK, CLSK, DNB, PG, and FB. Note: If any charts are too small to see, you can click on them to see the full image. 1.Frequency Therapeutics (FREQ)Symmetrical triangle getting tight, watching for a potential break out. If it breaks out to new highs, it can go to $65. 2. Ford Motor (F)Potential bullish ABCD setup if it can form a base at current levels and break out above the trend line. 3. FuboTV (FUBO)Got stopped out on this last week but willing to trade it again. Readjusted trend lines, looking for a reversal. Not interested if it breaks under $41.65 area. 4. Churchill Capital (CCIV)Merger with Lucid Motors news is still moving this stock quite a bit so just keeping an eye on it. 5. Beam Therapeutics (BEAM)Currently long with a small starter position as it may be starting to curl up for another move higher. The volume by price suggests that there's more support volume below than resistance above. Also, ARK has been buying BEAM recently. Stop loss currently at $98.50. 6. Snap Inc. (SNAP)Balloon raindrop candle right at all-time highs. Has been strong and still looks bullish. If it breaks above $66, it can test $70. Volume patterns also look good. Here's what a regular candlestick chart of SNAP looks like. 7. Mannkind (MNKD)Another balloon raindrop that's right at all-time highs. Same idea as the SNAP chart above. Looks bullish. A red to green move would be ideal on both MNKD and SNAP. Read here: How to Find and Trade a Red to Green Move - Stock Day Trading Strategy 8. RedFin Corp (RDFN)Another setup similar to SNAP and MNKD. Same idea, looking for a break out of highs above $97, except RDFN has earnings after market close this Wednesday so be careful about holding into earnings. There's also a high chance this can get to about $100 since stocks that go over $90 for the first time tend to get to $100 fairly quickly. 9. Verint Systems (VRNT)VRNT holding strong up here in a range. Keeping this on watch. 10. Luminar Technologies (LAZR)This stock continues to build a volume base but is having a hard time holding when it makes a move higher. Overall, still more bullish than bearish, but wouldn't be interested if it broke under $31.60 area. 11. Ferroglobe Plc (GSM)$3.45ish is the level to break for the bulls. Should be clear skies above that. 12. PagSeguro Digital (PAGS)PAGS showed some strength on Friday on a slight volume increase. Looks bullish for now but earnings coming up Feb 25th so keep that in mind. 13. Skillz (SKLZ)SKLZ might be looking to fill the gap below, which could be a buying opportunity if it bounces after that. If it decides to break out of the resistance trend line on volume though, look for longs. Nothing to do for now. 14. CloudFlare (NET)If NET closes over the trendline resistance it'll be bullish, if it breaks under $80.30ish, it'll be bearish. 15. ARK ETFs (ARKK and others)ARKK bounced off the 20 EMA as it has done before so it's worth looking at. ARKQ and ARKW have very similar setups. Currently long ARKQ, not interested in any if they make another swing low under 20 EMA. 16. CleanSpark (CLSK)Inside bar setup because Friday's candle is inside the previous candle. If 37.75 area breaks, the target is somewhere near $40.50, the high of the previous candle. 17. Dun & Bradstreet (DNB)DNB currently in a downtrend near all-time lows. Could be a good short opportunity using last weeks' swing high as the initial stop loss. 18. Procter & Gamble (PG)PG continues to be weak. Looking for shorts, not interested over $130. 19. Facebook (FB)FB broke down on Friday on higher than usual volume, closest support is at $255. Might be worth shorting if it bounces a bit on Monday. Need Chart Software?TrendSpider is a top-tier charting platform where traders can put their technical analysis skills to work. It offers automated technical analysis tools, dynamic price alerts, back testing, 1-on-1 training sessions for those who need extra help, and more. A very unique tool that TrendSpider has is Raindrop Charts, which can give you a great edge with your trading. Get 10% off TrendSpider plans by clicking here & using the coupon code TS10 when signing up. Related CategoryRelated ArticlesThanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted!

|

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed