|

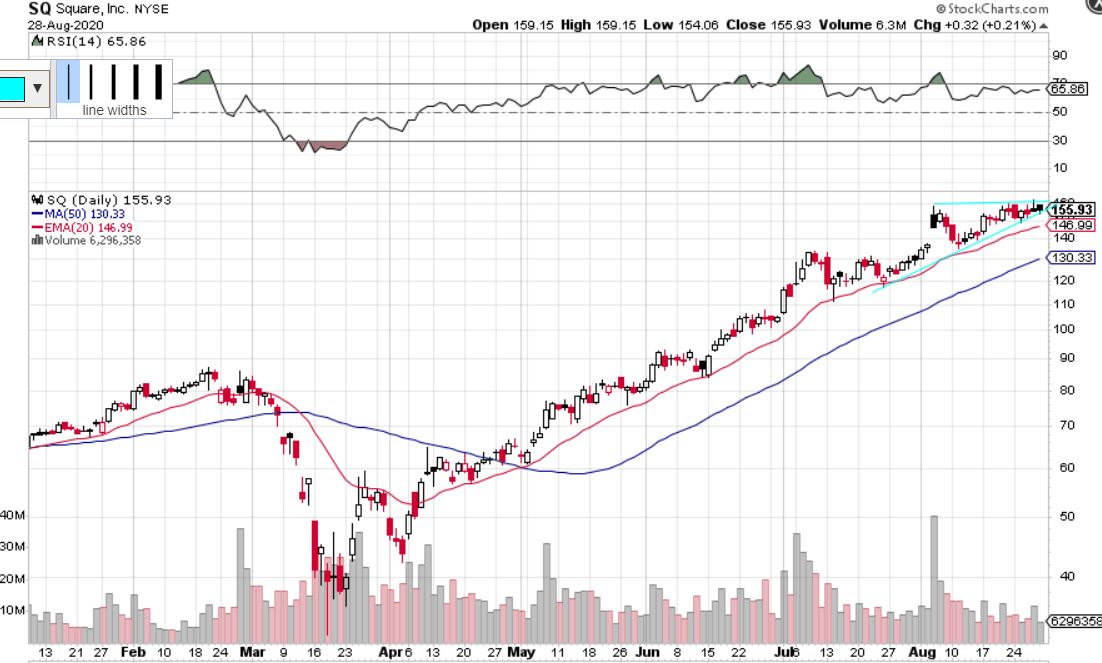

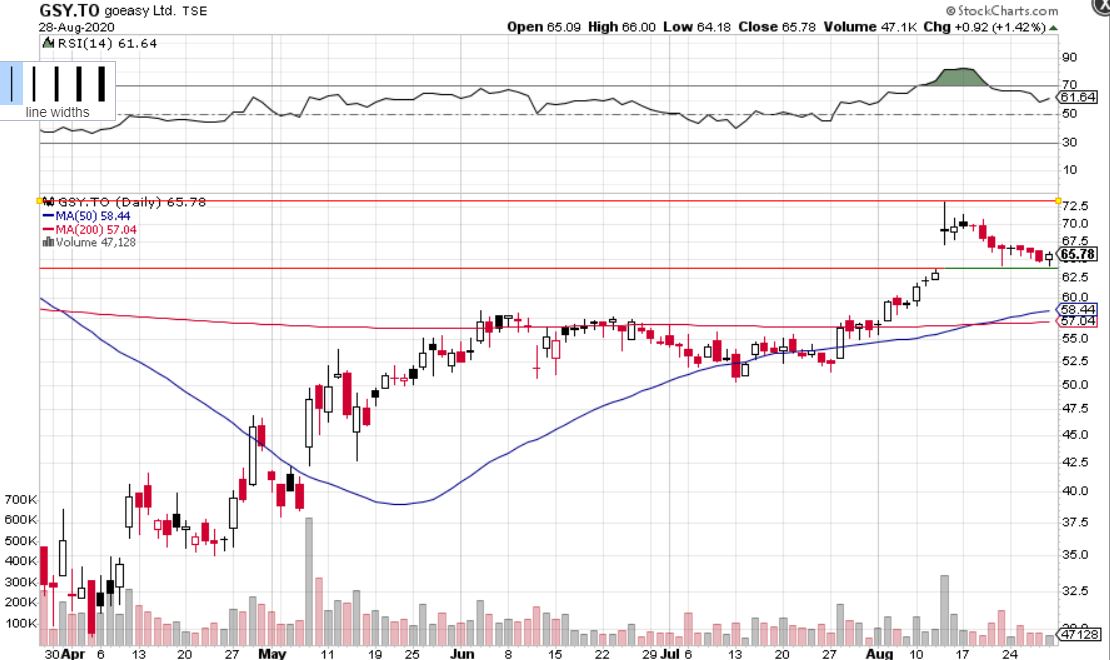

Here is this week's watchlist. Warning: Currently, the market is overbought and sentiment is very bullish, so a pull back may be imminent. We will not be getting aggressive with our long stock positions this week, unless the market pulls back and presents excellent entry points. 1. Gold (XAU/USD or GLD)Gold has bounced very nicely off trend lines recently and it seems to have bottomed out. We think gold will try to make another move higher. Support is near low $1900's. 2. Silver (XAG/USD or SLV)There's no doubt that silver has been crazy recently. This has caused a spike in implied volatility which has allowed us to profit from selling call options against our long positions. We will continue to do that as we think silver still has room to go higher. Purple horizontal line is a monthly time frame support, and the black horizontal lines are near term support & resistance. 3. United Parcel Service (UPS)UPS was on our watchlist last week. It is still in a range but it seems to be breaking out to the upside now as expected. First target is $165. 4. Tupperware Brands (TUP)Tupperware has made it to our watchlist 3 weeks in a row. Strong earnings gap a few weeks ago and high short interest can make it continue its upward momentum. It's in a range right now but above $15.50 it can break out. It's been slightly frustrating but the longer it goes sideways, the higher the potential upside move. Volume patterns are bullish. Long from $13.90, took partial profits at $15.10, but ultimately expecting a $17 or higher if it can get going. 5. Nikola (NKLA)Potential for a short squeeze here. Volume is usually higher on up days which indicates some bullish potential. It is curling higher from a previous support point (cup and handle type of pattern is forming). It can go to $45. Stop loss for a trade would be under $37. 6. Square (SQ)Square is forming an ascending triangle that can break out any time soon. Volume patterns and current trend indicates that the break out will be to the upside. $175 eventual target. 7. goeasy Ltd. (GSY.TO)goeasy had great earnings 2 weeks ago and has filled the gap and pulled back since then. This may be a good starting point for a long with a stop loss under the support level highlighted. GSY.TO closing over $67.50 will confirm more upside to come with a target back to $72.50. 8. Northwest Healthcare REIT (NWH.UN.TO)Long from 11.50, stop loss under 11.15. Forming a cup & handle. We're expecting this to potentially consolidate for a bit but our upside target is $12.40. 9. Richards Packaging (RPI.UN.TO)This is a fairly illiquid canadian stock so you need to be careful with position sizing. However, this stock usually consolidates sideways for a few weeks before heading higher. We don't see any reason for that to change anytime soon.

|

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed