|

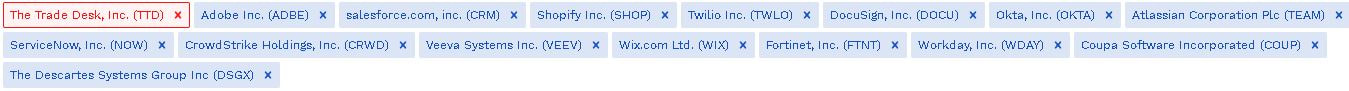

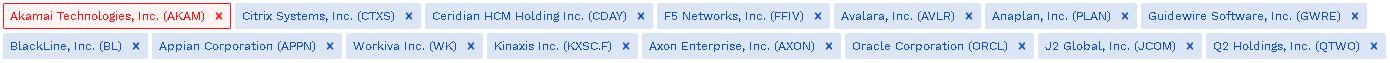

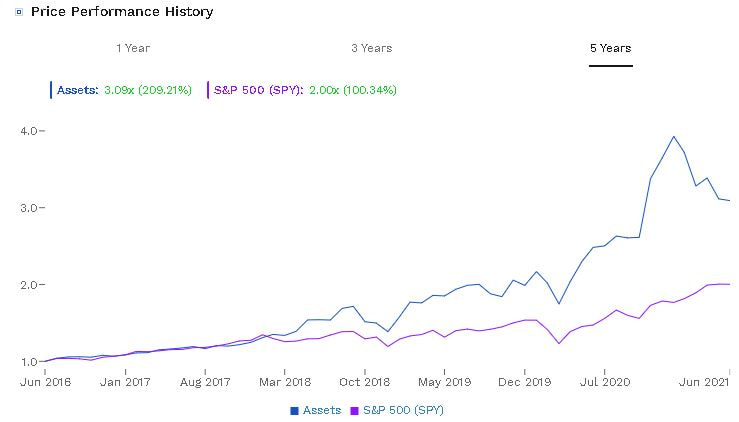

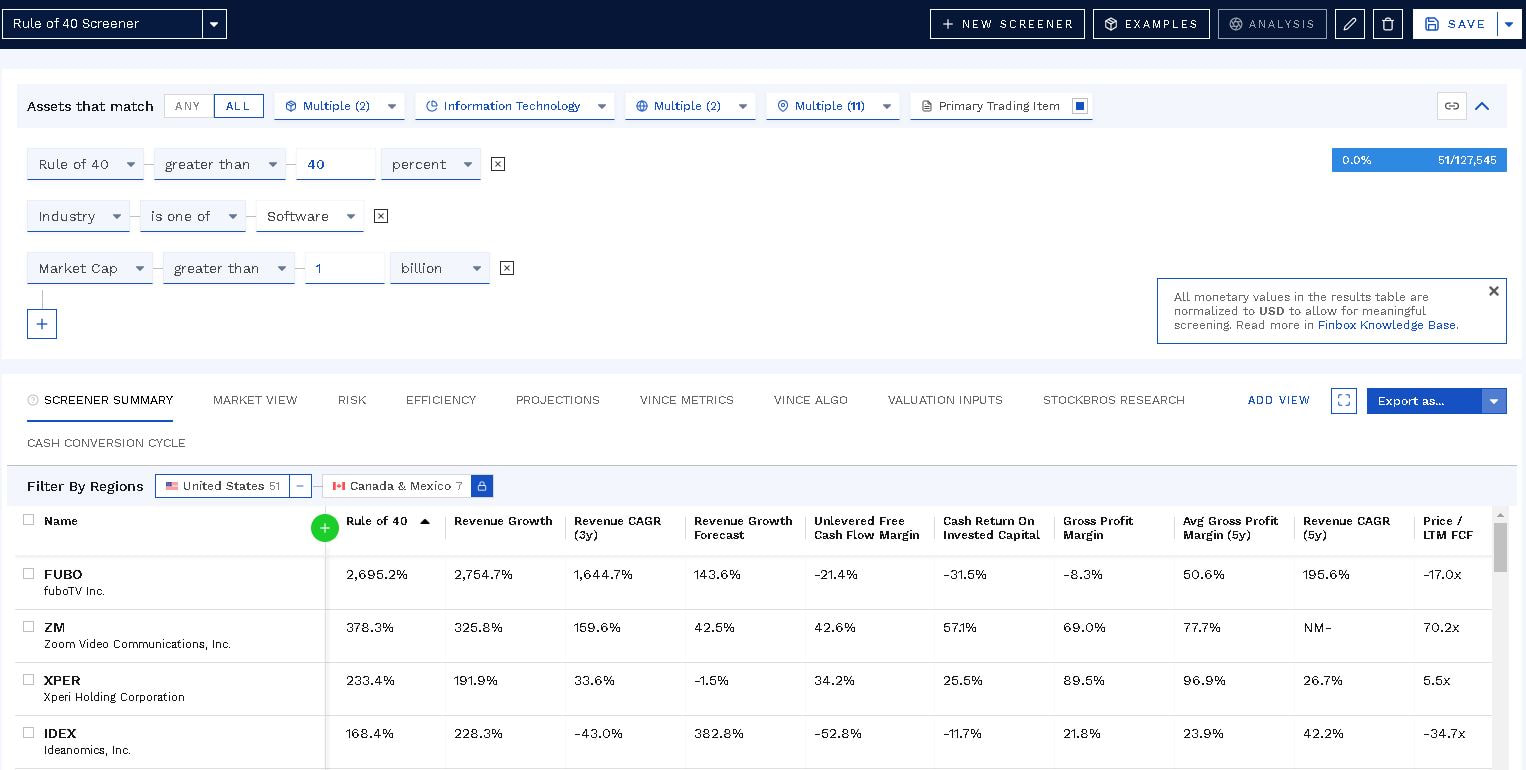

Looking to invest in Software-as-a-Service (Saas) stocks? A key metric to understand is the rule of 40. In this post, we'll explain what the rule of 40 is, how to incorporate it into your investing approach, and how to find stocks that beat the rule of 40. What is the Rule of 40?The Rule of 40 is a useful metric to use when analyzing SaaS stocks/companies. Many companies grow at a rapid pace at the expense of profitability while other companies are highly profitable but have low growth. The rule of 40 helps you decide which companies are worth investing in by measuring the trade-off of growth rate and profit margins. Essentially, a SaaS company's annual revenue growth rate plus its profit margin should be greater than 40 to be worth investing in, hence, the rule of 40. Rule of 40 formula = Revenue growth + profit margin Now you may be asking, which kind of profit margin? There are many ways that companies measure profit such as: gross profit, EBITDA, EBIT, free cash flow, net income, etc. So, which profit margins should you use? We have seen people use several kinds of profit metrics but the one we'd like to highlight today is FCF margins. There are a few reasons for us preferring FCF margins. One reason is that free cash flow is much more reliable than other metrics like EBITDA. FCF tells you the how much cash is leaving or entering the business after capital expenditures have been paid. Since the rule of 40 wants to measure cash burn/creation relative to revenue growth, it makes sense for us to use free cash flow. Another reason why we use FCF is because that's what the fundamental analysis platform Finbox uses. We use Finbox to easily scan for stocks that meet this criteria (it takes just a few seconds, more on this later). Rule of 40 Stocks OutperformIf you can find stocks that consistently meet the rule of 40 criteria, you're likely to have a winning portfolio (nothing is certain though). This has been true in the past and we expect this trend to continue going forward. To show how powerful the rule of 40 is, we decided to back test it. Below, is a portfolio of 16 SaaS stocks that have beat the rule of 40 every year for the past 5 years, the names are listed in the photo below. We also avoided picking stocks with low market caps (under 4B). The stocks that met the criteria are: The Trade Desk (TTD), Adobe (ADBE), salesforce.com (CRM), Shopify (SHOP), Twilio (TWLO), DocuSign (DOCU), Okta, Inc (OKTA), Atlassian Corp. (TEAM), ServiceNow (NOW), CrowdStrike Holdings (CRWD), Veeva Systems (VEEV), Wix.com (WIX), Fortinet (FTNT), Workday (WDAY), Coupa Software (COUP), and The Descartes Systems Group (DSGX). The 5-year return for this portfolio was 837.74% vs. 100.34% for the SPY (not including dividends). Pretty good returns, no? Of course, this has survivorship bias because we hand-picked a portfolio that managed to consistently stay above 40 for 5 years, but that's not the point. The point is, the rule of 40 works and we want to show how much it works if you can find a stock that beats it for 5 years straight. The trick is finding these stocks. Maybe you could combine some points in our checklist titled How to Find and Pick High Quality Stocks to Invest In to help give you an idea of what stocks are good contenders for consistently beating the rule of 40. Below is the 1-year performance for the same portfolio. The rule of 40 stocks returned 43.2% vs 31.42% for the SPY. This isn't as good as the 5-year performance, but still good nonetheless. The results are in line with the QQQ (Nasdaq ETF) that has returned about 42% in the past year. While it may not sound too impressive that rule of 40 SaaS stocks matched the QQQ in the past year, the 5-year performance of 837% speaks for itself. The Nasdaq's 5-year performance including dividends (starting June 2, 2016) is about 214%. Below, we back tested a portfolio of 15 SaaS stocks that DON'T meet the rule of 40 criteria. We picked stocks that only beat the rule of 40 two times or less in the past 5 years. The results are telling. Although the portfolio beat the SPY, it basically matched the QQQ in the same time period (214%) and heavily underperformed the 837% returns from the portfolio above. In a 1-year period, the non-rule of 40 stocks underperformed the SPY by about 2%. Although the rule of 40 is generally used for SaaS stocks, it wouldn't necessarily be a bad idea to use this metric for non-SaaS stocks as well (in our opinion). It simply is just a measure of revenue growth and profitability. Those 2 metrics technically apply to every company, not just SaaS. But, if you want to play by the rules, use it for SaaS stocks only. If the past repeats itself, you'll have a good chance of beating the market using the rule of 40. How to Find Rule of 40 StocksFinding rule of 40 stocks take a few seconds with Finbox. All you have to do is put "Rule of 40 greater than 40%" into a screener and you'll find a bunch of stocks that meet the criteria. You can see the criteria we set in the image below. We added "market cap greater than $1B" and "Industry is one of software" that way, we only pick up software stocks since we're looking for SaaS stocks. If you click on the image below, it will take you to the screener. The screener picked up 51 US stocks and 7 Canada/Mexico stocks. That's a good amount of high potential stocks to look through, get going with it! Thanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted

|

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed