|

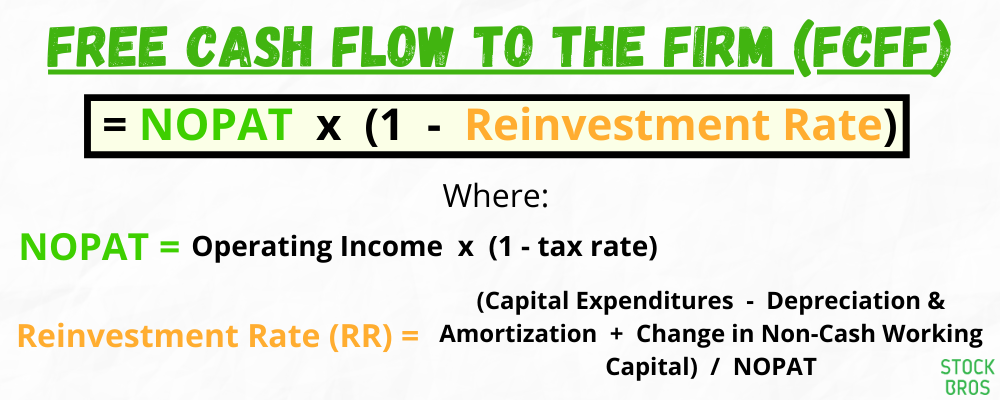

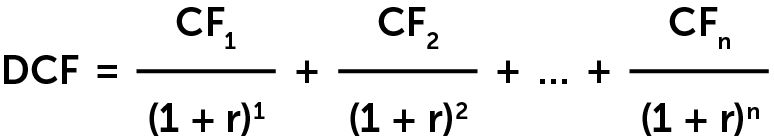

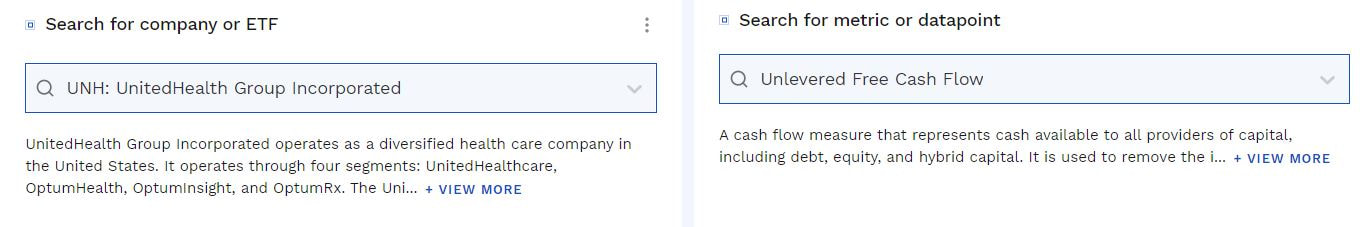

Would you rather receive $100 one year from now? Or would you want to receive it today? The correct answer of course is today. That's because money loses value over time due to inflation and the opportunity cost of investing it. Well, the point of DCF analysis is to forecast future free cash flows of an investment/company and then discount them back into the present in order to find out what the future money is worth today (present value). If the present value of the future free cash flows are greater than the current cost of the investment, then it is considered a good/undervalued investment. This is an introductory article to discounted cash flow analysis. If you are already very familiar with how DCF works, check out our advanced DCF article where we go in much greater detail. Choosing a Discount Rate For Your CalculationIn order to find out whether the investment is feasible, you have to discount its future free cash flows using a discount rate. So how do you choose the discount rate? The proper way is to use a company's weighted average cost of capital (WACC). WACC is the weighted average of the cost of a company's debt and the cost of their equity. To read our blog post about WACC, click here. Cost of debt is essentially the interest rate of what it would cost a company to raise debt (issue bonds, debentures). Cost of equity is a theoretical rate of return required to satisfy equity investors (shareholders) based on the risk of the company. Cost of equity is not a tangible number, but It is often calculated using the Capital Asset Pricing Model (CAPM). At times, the CAPM model can be flawed especially in this low interest-rate environment because it has the potential to calculate a very low cost of equity such as 2% (depending on the company). We personally don't think any stock is safe enough to have a 2% cost of equity and in that scenario we would raise the cost of equity to a number that makes more sense for that company (our rule of thumb is a minimum 5% cost of equity). Safe corporate bonds pay around 2% yields, so why would you invest in a stock for 2%? Individual stocks also carry company and industry-specific risk that you will be exposed to unless you are diversified into many different stocks. This is why sometimes a more common-sense-based approach is better to calculate cost of equity rather than relying on CAPM which can calculate artificially low numbers. If the CAPM calculation makes sense to you, use it. If not, adjust that yourself based on your personal required rate of return for that stock and then combine that with the cost of debt to get the WACC. Let's assume you calculated that a company's WACC is 7%. You would then use 7% as a required rate of return for your calculation (discount rate and required rate of return are interchangeable terms). This means that you would require a 7% annual return for the investment to be "fair value". WACC goes beyond the scope of this blog post as it would require a lot more explaining in order to fully understand how to calculate it. This is just an introduction to get you more familiar with DCF valuation. How to do a DCF Calculation For Stocks Using Unlevered Free Cash FlowDCF valuations can either be done using unlevered free cash flow, also known as free cash flow to the firm (FCFF) or levered free cash flow, also known as free cash flow to equity (FCFE). For the purpose of this blog we will only be going over the way to calculate DCF using unlevered FCF (FCFF) as we feel it is a more accurate way of calculating intrinsic value. The formula for unlevered free cash flow can be seen in the image below: You need to know FCFF so you can input it into the DCF formula. The formula for DCF is as follows: CF = Cash Flow R = Discount rate (WACC) The formula above applies to both unlevered and levered FCF where the "CF" in the formula would be replaced with either FCFF or FCFE depending on which type of FCF you are using. In unlevered DCF valuation, you are forecasting the future unlevered free cash flows for a specific period of time (for example the next 5 years), discounting them, and then adding them all together. After adding all the discounted cash flows, you then calculate a terminal value of all the future unlevered free cash flows. Then, you add the two numbers together and this gives you a fair enterprise value for the company. Lastly, you subtract total debt of the company from the enterprise value you calculated, add back cash, and that gives you the fair value market cap of the company (example below). A terminal value is a calculation of the present value of all the future free cash flows going into perpetuity (unlimited number of years). To find the terminal value, you have to assume a perpetual growth rate for the company. The perpetual growth rate could be set to the risk-free rate (the rate at which you can earn risk free money, such as the 10 or 30-year bond yield), or it can be set to historical GDP growth. Usually, a perpetual growth rate is around 1.5-2.5% depending on how aggressive you want to be with the valuation. Anything higher than 2.5%-3% may be too aggressive in the valuation, which could potentially give the company a higher valuation than it deserves. In unlevered DCF analysis, the terminal value formula is as follows: Final Year Discounted UFCF * (1 + Terminal UFCF Growth Rate) / (WACC - Terminal UFCF Growth Rate) = Terminal Value Example of a 5-Year Unlevered DCF ValuationCompany XYZ Market Cap: $100 million Cash & Cash Equivalents: $5 million Total Debt of Company: $15 million Discount Rate (WACC): 10% 2020 est. unlevered free cash flow: $10 million 2021 est. unlevered free cash flow: $12 million 2022 est. unlevered free cash flow: $12.5 million 2023 est. unlevered free cash flow: $13.5 million 2024 est. unlevered free cash flow: $15 million We have our forecasted free cash flows, now we have to discount these cash flows using the DCF formula above. Year 1 (2020): 10,000,000 / (1+0.10)^1 = $9,090,909 Year 2 (2021): 12,000,000 / (1+0.10)^2 = $9,917,355 Year 3 (2022): 12,500,000 / (1+0.10)^3 = $9,391,435 Year 4 (2023): 13,500,000 / (1+0.10)^4 = $9,220,681 Year 5 (2024): 15,000,000 / (1+0.10)^5 = $9,313,819 Add those numbers and you get: $46,934,199 Then, you need to calculate the terminal value using the formula above. We will assume a perpetual growth rate of 1.75% per year for this company. Terminal value = 9,313,819 * (1+0.0175) / (0.10 - 0.0175) = $114,870,434 Then, add the terminal value + the 5 years of cash flow to get the fair enterprise value: $161,804,633 Lastly, subtract the debt of the company ($15 million) from the enterprise value and add back cash & cash equivalents ($5 million) to get fair value of equity: $151,804,633 Final valuation of company XYZ: $151,804,633 market cap. The current market cap of $100,000,000 would mean that this company is undervalued. Problems with DCF ValuationAs you've probably noticed, DCF involves some assumptions which are bound to be inaccurate. You assume the perpetual growth rate of a company, forecast future free cash flows based off of multiple factors (or use analyst forecasts if you don't want to forecast yourself), and estimating cost of equity using CAPM isn't always a great idea in our opinion. Also, the fair value estimation is highly sensitive to the discount rate you come up with so it is important that the discount rate is as "accurate" and as logical as possible. DCF is also not as useful for some industries such as financials, as a better way to value financial stocks is by using the Excess Returns Model. Lastly, DCF can be highly inaccurate for companies with negative free cash flow or start up companies with not much history to look back to for the purpose of forecasting future cash flows. It is most accurate with stable companies that have a predictable business model and a long history of stable free cash flow. Nonetheless, DCF is one of the most important and utilized style of valuations, and it should be taken into consideration when valuing a company. How to Make DCF Analysis EasyYou might be thinking: "How am I supposed to calculate FCFF when I don't even know where to find all those metrics in the formula?" or "Who has time to do all those calculations and forecasts?". The good news is, it's not as complex as it seems if you have the proper tools. You can find every single metric you need by using Finbox. For example, if you just type "Unlevered Free Cash Flow" for any company you're interested in, you'll find information for the last 10 years. It's not just free cash flow, there's 1000+ metrics to choose from. Here's an example using unlevered free cash flow for United Health Group (UNH) stock: As you can see, there's lots of data to look back at just from this one metric. Looking at past cash flow history can help you gauge how the future will be, so this is useful. You can even find analyst forecasts to help you. On top of this, you can use one of Finbox's pre-built valuation templates. This makes it very easy to value a stock. More info on this in our advanced DCF article. Don't Want to do any Valuations Yourself?If you don't want to do any valuations yourself, there's a solution for that as well. All you have to do is search for a company, and Finbox will tell you what they think it's worth, as well as what analysts think it's worth. The Finbox valuations are based on their different models as you can see in the image below just under where it says "11 models". Those are clickable, meaning you can view the calculations in each model to see how the fair value was calculated. In addition, you can change the inputs of those models yourself in case there's any forecasts you don't agree with. The fair value would change accordingly as you make your personal changes. Below is an example with Apple (AAPL) stock: With over 900 million data points, Finbox gives you access to accurate, up-to-date information on any stock in the world. It provides advanced stock screeners, investment ideas, and more, making investing much easier. Learn more here. Thanks for reading! If you enjoyed this article, please consider subscribing to our free newsletter to get articles like this sent to you when they are posted! You can also give us a follow on twitter @StockBrosTrades. Related Articles: |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed