|

In this report, we will be taking a look at eBay, the well-known online marketplace.

Company Description

Investment Summary of eBay

What are eBay's Catalysts?

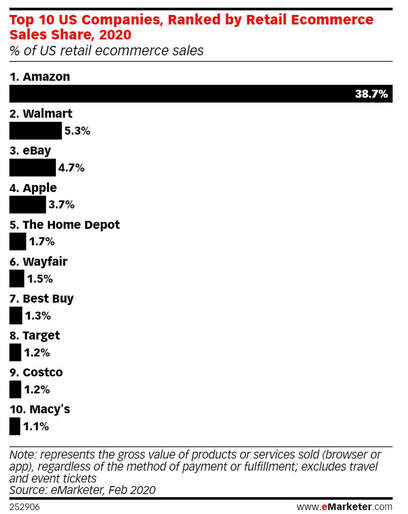

eBay has been losing market share to its competitors in the last few years. Just recently, Walmart surpassed eBay for the first time to take the second spot for market share in the ecommerce industry. However, we believe that the following catalysts will allow eBay to turn things around and generate great shareholder value.

To begin with, one of the main issues surrounding eBay is the website itself. It is currently outdated and not very user friendly. Consumers prefer to have a seamless experience when online shopping and any sort of friction can lead to customers relegating a website to being a secondary option. However, management has vowed to change the design of its marketplace to make it more efficient and enjoyable for the customers. Importantly, management has zeroed in on who their most valuable customers are: marketplace sellers. According to the firm, sellers on average buy more than twice as much as those who are simply buyers. Therefore, the strategy is not only to improve the buying experience, but also to encourage customers to sell. To do so, eBay is focusing on simplifying the listing process and creating Seller Hub tools to incentivize small businesses to join the platform. They state that their goal is to make sellers view the company as a true partner that can help. The Seller Hub tools are free to use and include interesting analytics such as real-time competitive pricing information and traffic data. In addition, sellers have access to what the company claims are powerful marketing/promotion tools as well as new ways to look at sales and selling costs. Furthermore, management expects to transition most of all global sellers to its managed payments which is expected to generate an additional $2 billion in revenue and $500 million in operating profit in 2022. This more than makes up for the loss of future revenue/operating profit from the divestiture of their classified business, which we believe was a fantastic move. The reason why we love the divestiture is twofold: First, it allows management to focus solely on improving its marketplace business and secondly, it unlocks much more shareholder value. To elaborate on the latter, lets make some quick calculations: Classifieds Business: Revenue = $1.1 billion Average Operating Margin = approximately 37% (average of the last 6 quarters) Average Operating Profit = $407 million Divestiture of Classified: $2.5 billion before taxes in cash and $6.7 billion equity stake in Adevinta As you can see, it would take quite a while for eBay to earn the $2.5 billion in cash and even longer for the total $9.2 billion, especially when discounting the future operating income. Management has effectively taken the classifieds’ potential and realized it into an upfront windfall of tangible value (equivalent to nearly a quarter of its entire market cap) that can either fund their turnaround efforts or be returned to investors via dividends and buybacks. This is on top of the $3.2 billion dollars remaining of authorized share repurchases. We are Confident in eBay's new CEO

Spear heading eBay’s turnaround is new CEO Jamie Iannone who was appointed in April. Iannone was the CEO of Walmart subsidiary Sam’s Club which has served as a testing ground for Walmart’s digital strategy. He is credited for Sam’s Club growth in membership and online sales and had been recently promoted to Walmart’s Chief Operating Officer for U.S. e-commerce in late February before taking the top spot at eBay. Before joining Sam’s Club, he was also executive vice president of digital products at Barnes & Noble, where he helped oversee its Nook devices and digital book business.

The fact that the company who has just recently overtaken eBay in market share had placed Iannone to oversee its digital strategy is a testament to his credibility. This gives us the confidence to believe that eBay will properly execute its turnaround strategy. eBay's Competitive Positioning

eBay is the third largest competitor in terms of market share behind Amazon and Walmart

Strength – eBay is a well-established ecommerce giant who pioneered the industry since its founding over 2 decades ago. The sellers on its platform on average buy more than twice as much as the users who simply buy.

Weakness – The company has lagged competitors Amazon and Walmart due to its outdated platform and by focusing on multiple ventures over the years. As a result, it has lost market share while others have gained. Opportunities – Covid-19 has accelerated the shift to ecommerce. Many businesses have seen the value that can come from an online storefront and will be looking to increase their online presence. The company’s divestiture of non-core assets could make it a more attractive takeover target. Threats – Increased competition from rising companies like Etsy and Shopify. In addition, eBay’s technology is not proprietary, and anyone can start their own online marketplace to compete. How Much is eBay Worth? - Valuation

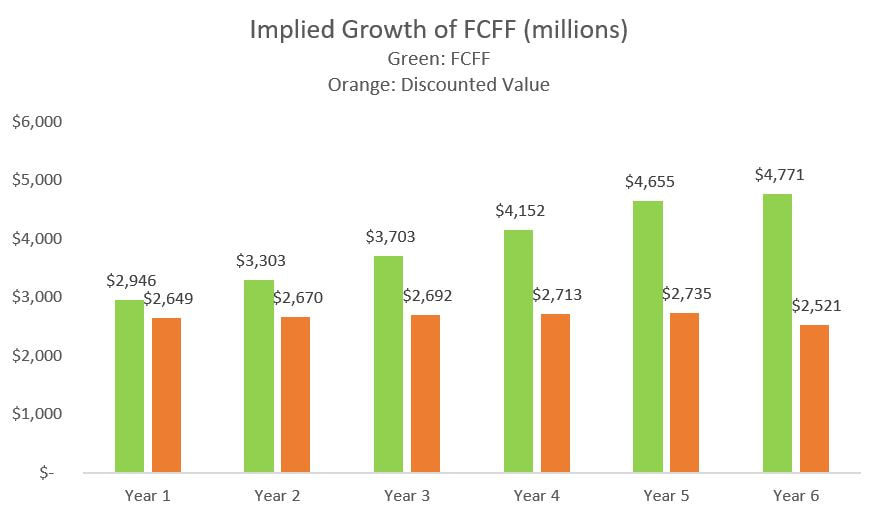

Currently, the price of eBay is $55.21, which implies that the market is expecting the companies Free Cash Flow to the Firm to grow at a rate of 12.12%. For more info about DCF calculations and how they work, click here.

Assumptions for implied growth:

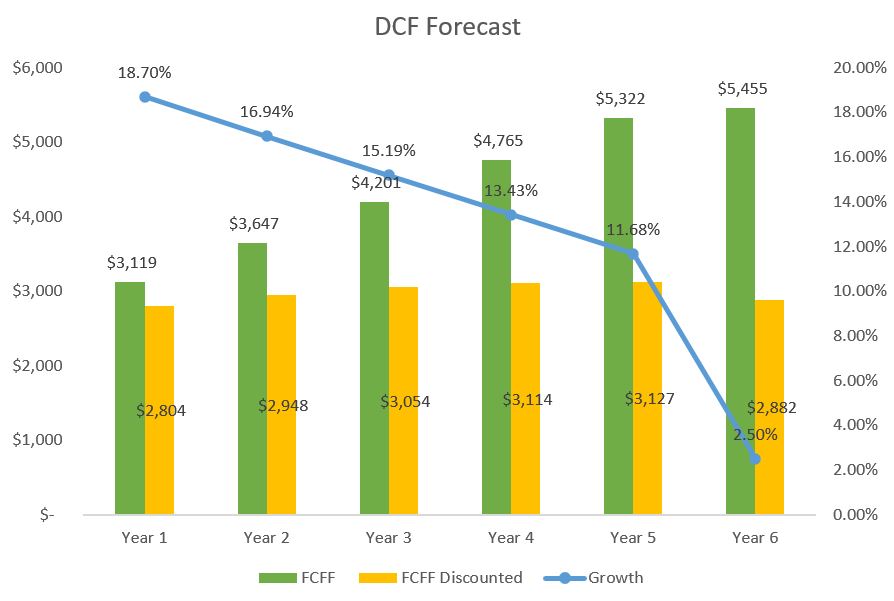

We believe that eBay is currently worth $63.33 per share (DCF value) with the potential to be worth up to $74.50 per share if their sale of the classifieds business closes in 2021 (assuming a price of $9.2 billion minus an approximate $500 million in taxes, discounted at 11.22%) Assumptions for valuation in addition to the above:

Risks Associated with Investing in eBay

There is the risk that eBay may not be successful in turning around its marketplace business and will continue to lag its competitors. This scenario would probably result in continued loss of market share with the potential for declining revenues and profits. Let’s take a look at what factors could potentially cause this to happen.

To begin with, competitors have gained ground on eBay due to improved user experiences, greater ease of buying goods, lower (or no) shipping costs, faster shipping times and more favorable return policies. As stated on the company’s most recent 10-Q, eBay is aware that they have a long and challenging road ahead of them: “Certain platform businesses, such as Alibaba, Amazon, Apple, Facebook and Google, many of whom are larger than us or have greater capitalization, have a dominant and secure position in other industries or certain significant markets, and offer other goods and services to consumers and merchants that we do not offer. If we are unable to change our products, offerings and services in ways that reflect the changing demands of ecommerce and mobile commerce marketplaces, particularly the higher growth of sales of fixed-price items and higher expected service levels (some of which depend on services provided by sellers on our platforms), or compete effectively with and adapt to changes in larger platform businesses, our business will suffer.”

In addition, many sellers on eBay also sell their products on other platform such as Amazon, Etsy, Wayfair, Google, Facebook and Shopify. Therefore, the company runs the risk of seeing sellers pulling their listings from eBay in favor of other platforms should they see more efficient returns elsewhere. It also doesn’t help that there are very low barriers to entry where businesses easily can launch online sites or mobile apps by using commercially available software or partnering with successful e-commerce companies. This can lead to the threat of increased competition from local competitors in developing countries that have unique advantages, such as a greater ability to operate under local regulatory authorities. Therefore, it is crucial that the platform redesign is done correctly without frustrating users.

|

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed