|

Here's this weeks watch list. The stocks to watch BESIDES GME and AMC are: VMW, MNMD, GE, X, IHRT, BLNK, BBIG, CRM, V, DMTK, and COUP. Good luck to all! 1. VMWare (VMW)Interesting setup here in VMW, range getting tight. Low relative volume pull back (bullish) compared to its runup in April. Break out over $163, only interested if it closes above that. 16.38% live short interest according to ortex.com Here's the weekly timeframe for VMW. What makes the chart even better is that it's an inverse head and shoulders on the this timeframe. Not to mention, it's a fundamentally sound company that isn't excessively priced. Read: The Top Chart Patterns You Need to Know and How to Trade Them 2. Mind Medicine (MNMD)Same plan as last weeks' watch list: "MNMD looks like it has big upside potential if it breaks out on volume. So far, volume patterns are strong. Stop loss under $3 ish if we take a position." 3. General Electric (GE)GE has shown some nice strength recently but hasn't been able to get past $14.40. Looking for a break out of $14.40 to target $15 or higher. Maybe even a few more days of basing at this price would be good to buy in anticipation of a break out. 4. United States Steel (X)Overall trend is up and somewhat predictable as of right now, so just following the trend. Excepting new highs. Not interested if there's several closes under the 50 SMA or if it goes under the recent swing low. 5. iHeart Media (IHRT)Retesting the break out area and is likely to continue higher. Would be even better if it retests it for a few more days to confirm the new support. Note all the bullish volume. 6. Blink Charging (BLNK)BLNK weekly chart. Held support a few weeks ago but now it has to get above $41 resistance to get to its next target around $45-46. BLNK currently has 30.54% live short interest. 7. Vinco Ventures (BBIG)Breakout on heavy volume here but didn't have enough strength to close near highs. Closed right at a trend line. No immediate plans for right now, but have seen this ticker pumped by some big names on twitter, plus it has 23% short interest. If you haven't learned already, don't underestimate the power of crowds. 8. Salesforce.com (CRM)CRM did a classic breakout and retest. We had it on our watch list last week for this exact reason, waiting for the retest. Looks good for a long until at least $250 in our opinion. 9. Visa (V)Visa is repeating a bullish pattern from March that saw it reach new highs. We're willing to bet that it'll reach new highs some time soon. Resistance at $233 though currently, watching that. 10. DermTech (DMTK)DMTK has escaped this trendline but before going long, we're looking for a close above that candle shown in the chart, which would also be above the 50 MA. Assuming the stock doesn't go under $37.50 before that, that where our SL would be. 34.72% short interest on this one. 11. Coupa Software (COUP)Went short this is the mid 230's last week from the watch list (stop loss 241 ish). Still overall bearish, targeting $220 initially, and $200 if it really starts to break down. Don't have a large short position though because it has high short interest. Thanks for reading! We hope the article was useful to you. If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted! GET 2 FREE STOCKSGet 2 FREE stocks worth up to $2300 when you sign up for Webull and deposit $100. Webull is an easy-to-use, commission-free trading platform with no monthly fees that offers stock, ETF, options, and cryptocurrency trading. Click here to sign up and get free stocks Related Articles |

Categories

All

Archives

September 2022

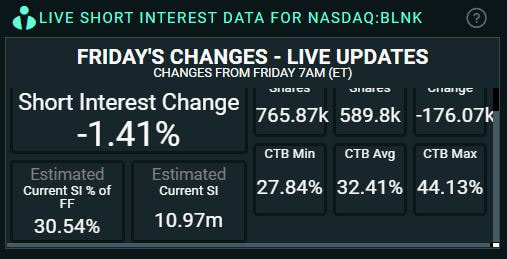

|

RSS Feed

RSS Feed