|

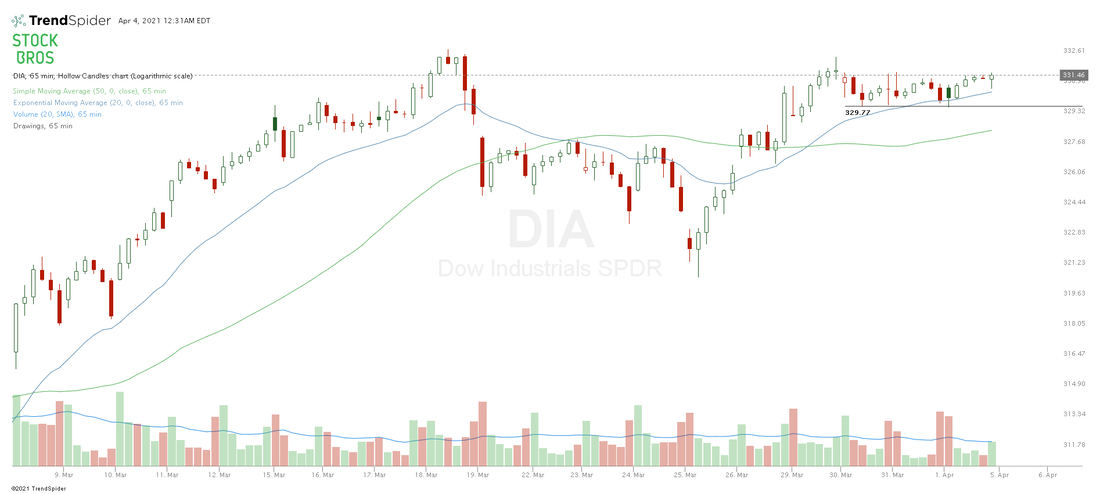

Here's this weeks' stock watch list. The stocks to watch are: CCK, GOOG, MSFT, QQQ, DIA, TD, TROW, HST, CTRN, XOM, QRVO, and GRMN. Happy trading! 1. Crown Cork & Seal (CCK)Nice breakout/strength here. Resistance near 101.50/102 but overall looks pretty bullish. Would be good to buy if it dips. The most recent raindrop on the chart below shows that there was a good amount of volume near the high range of the day, which is bullish. 2. Alphabet Inc. (GOOG)Still relatively strong to other tech stocks, approaching resistance. Looking for some consolidation/dip if it doesn't break resistance for an eventual move higher. 3. Microsoft (MSFT)MSFT overall bullish but is trading at the top end of a short-term upwards channel and can possibly pull back from here. Look for a break out or a pull back to the low end of the range for a buy. Here's the weekly chart for MSFT which looks very bullish as it bounced off the 20 EMA which it has done many times in the past. 4. Nasdaq ETF (QQQ)QQQ coming out of the inverse head and shoulders here right at the neckline resistance. ADX has crossed over into bullish territory. Overall, looks good but has to break through resistance first. 5. Dow Jones ETF (DIA)65-minute time frame. Dow holding over $329.50, so as long that holds, the short-term trend remains bullish. 6. Toronto-Dominion Bank (TD)We're currently long TD as the trend is still higher from here. Will add more to the long if it breaks the trendline resistance above. Other Canadian bank stocks have similar charts such as RY and BNS. 7. T.Rowe Price (TROW)Nice ABCD setup here. It's good for a long with a stop loss under B and a target at new highs. 8. Host Marriot Financial (HST)Volume shelf/support base is building up here for a potential break out this trend line. On watch. 9. Citi Trends (CTRN)Same idea as the chart above. Volume base building up and looking for a break out. 10. Exxon Mobil (XOM)Another volume shelf building a base. Retesting a previous resistance area (now support) from June at $55. 11. Qorvo (QRVO)Balloon raindrop breakout in QRVO. Would like to see some consolidation for a chance to get in a good buy entry. 12. Garmin Ltd. (GRMN)Similar idea to QRVO chart above. GRMN can continue higher but would prefer some consolidation first or a retest of the horizontal breakout area. Need Chart Software?TrendSpider is a top-tier charting platform where traders can put their technical analysis skills to work. It offers automated technical analysis tools, dynamic price alerts, back testing, 1-on-1 training sessions for those who need extra help, and more. A very unique tool that TrendSpider has is Raindrop Charts, which can give you a great edge with your trading. Get 10% off by clicking here & using the coupon code TS10 when signing up. You can also sign up for a 7-day free trial risk free Related CategoryRelated ArticlesThanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted.

|

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed