|

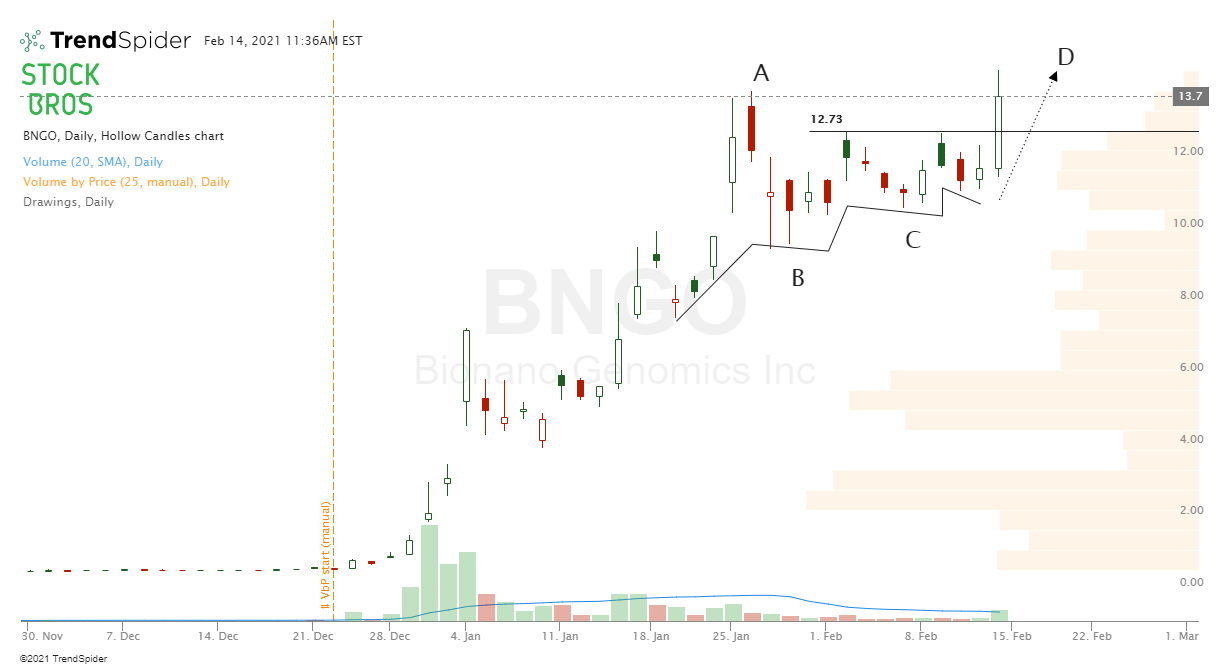

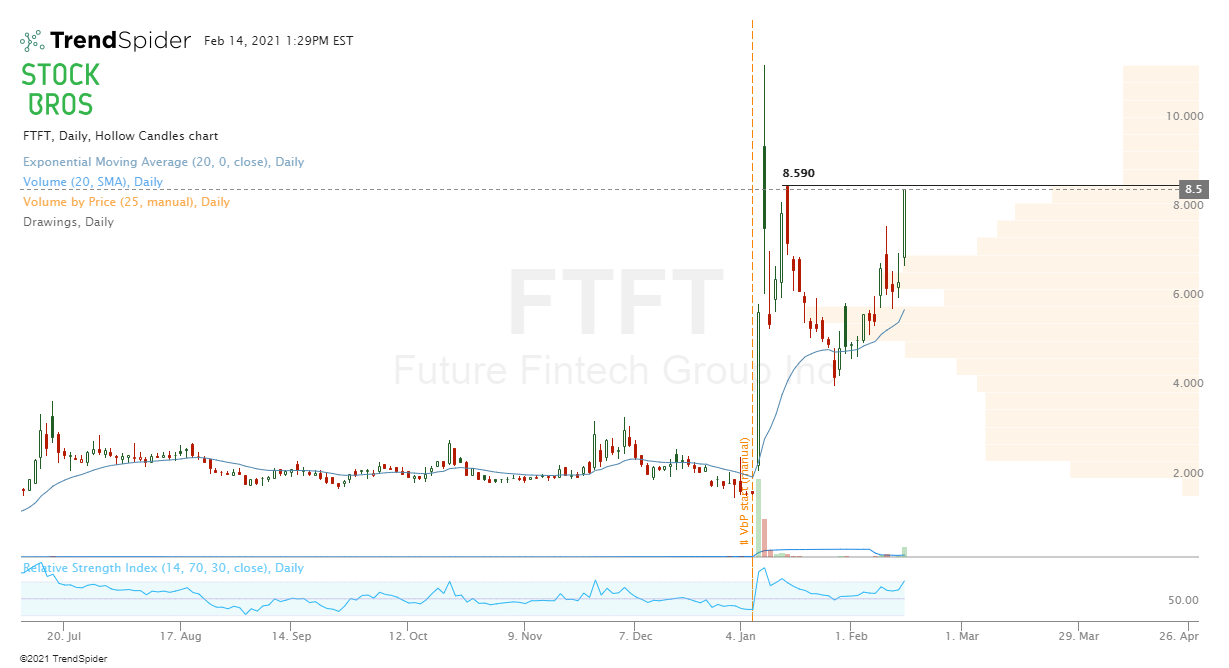

Here's this weeks' stock watch list. The stocks to watch are: BLNK, PENN, BNGO, XL, SUNW, FUBO, LAZR, JKS, SILVER, GLSI, NNDM, LGVW, NIO, APPN, MORN, FTFT, ADBE, GOOG, EBAY, and NEE. Since the market is starting to get overextended, we may be quicker than usual to take gains/cut losses or may not get as aggressive with long positions. Preserve your hard-earned gains! Also, the market is closed Monday, so this watch list is for Tuesday-Friday. Note: If any charts are too small to see, you can click on them to see the full image. 1.Blink Charging (BLNK)Similar setup from 2 weeks ago when it printed a doji candle at the 20 EMA. Looking for a reversal, not interested if it breaks Friday's low. 2. Penn Gaming (PENN)Nice engulfing candle bounce just above the 20 EMA. No position currently, hoping for a slightly lower entry. 3. Bionano Genomics (BNGO)Tweeted this setup just before it broke out on Friday and closed near $13.80, but there's still potential for a continuation play. On watch. 4. XL Fleet (XL)XL fleet is bottoming out, slowly creating an inverse head and shoulders kind of formation. No position so far but will be keeping a close eye on it. 5. Sunworks (SUNW)Watching for a reversal around these levels as this can be the next ABCD setup like the BNGO chart above. 6. FuboTV (FUBO)FUBO printed a nice engulfing candle right at the 20 EMA but its still in that trend line range, no position for now. Not too much volume overhead to act as resistance, and there's high short interest. Good candidate for a red to green move. You can read about red to green moves here. 7. Luminar Tech (LAZR)A successful play from last weeks' watch list that still has room to go higher. High short interest combined with a nice volume shelf and bullish chart pattern. Currently long from $34. Stop loss can be under Friday's low or under $31. 8. JinkoSolar (JKS)Another bullish chart with a volume shelf that can push it higher. Not interested if it breaks the support trendline. 9. Silver (XAGUSD)Silver is forming an inverse head and shoulders formation and looks more bullish than bearish. Resistance around $30. 10. Greenwich Life Sci. (GLSI)This has gone crazy before and it can do it again. Support and resistance levels are marked on the chart. Volume shelf is building up at current prices. GLSI is a biotech stock so please be careful and make sure there aren't any upcoming events or trials that can take you by surprise! 11. Nano Dim. (NNDM)Looking for another ABCD setup here. If it holds here for a bit (as marked in the chart) then it could be a great buying opportunity. The last 2 trading days, it topped around $16.15 so that's a level to watch for bulls. 12. Longview (LGVW)LGVW holding a breakout support here. Looks decent to buy near the low end of the range. Not interested if it starts breaking under $21.75. 13. NIO Inc. (NIO)NIO currently retested a trendline. Looking for a reversal candle around this level. More support volume slightly below than there is resistance volume above. 14. Appian Corp (APPN)Look for a breakout of the zone drawn in the chart. Preferably on high relative volume. 15.MorningStar (MORN)Balloon break out in MORN. Looks like it can go higher. Use Friday's low as a support level ($244), targeting $255. 16.Future Fintech(FTFT)FTFT had a volume and price spike on Friday and is now approaching a previous resistance. Hopefully it breaks through, retests and holds, for an easy long. 17. Adobe (ADBE)Range is getting tighter on ADBE currently at the top end of the range. Not a lot of resistance volume overhead so a breakout could be nice. If it starts to roll over, then its a short-term sell. ADBE is a great long-term hold though, we wrote an article about it that we will release soon! Sign up for our free email list to get research reports/watchlists and more sent to you when they come out. 18. eBay (EBAY)Broke above a multi-month resistance and is now holding above it. Short-term support at 61.65 area. If we go long, we'll use that as a stop loss level. 19. Alphabet (GOOG)65-minute time frame. Hoping for a pull back to the volume shelf and then higher. It has been holding very nicely since its strong earnings gap. 20.NextEra Energy(NEE)From last week's watch list. We were watching for either a break down or break out. Looks like we're getting a break down. Might be a good short to hedge long exposure. Need Chart Software?TrendSpider is a top-tier charting platform where traders can put their technical analysis skills to work. It offers automated technical analysis tools, dynamic price alerts, back testing, 1-on-1 training sessions for those who need extra help, and more. A very unique tool that TrendSpider has is Raindrop Charts, which can give you a great edge with your trading. Get 10% off TrendSpider plans by clicking here & using the coupon code TS10 when signing up. Thanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted! Related CategoryRelated Articles |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed