|

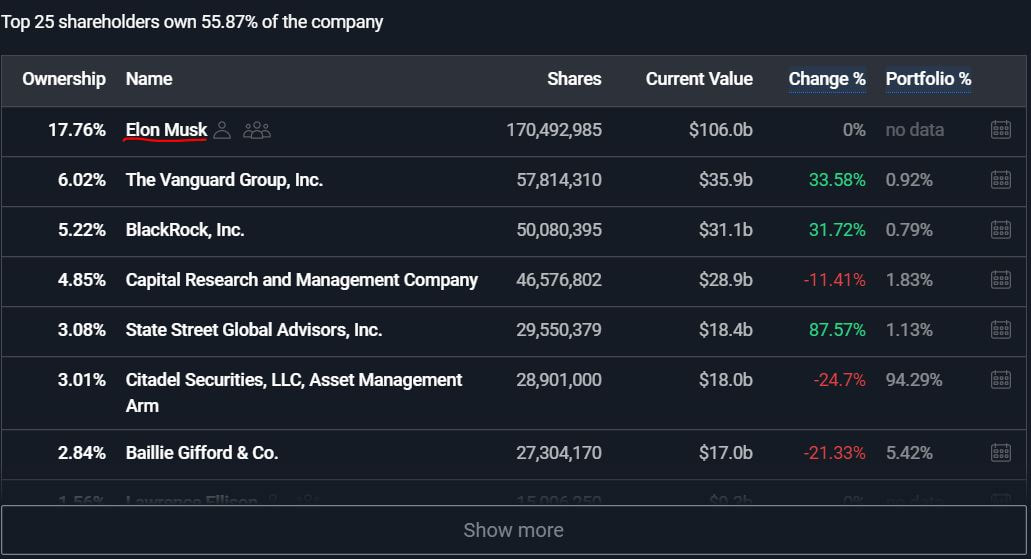

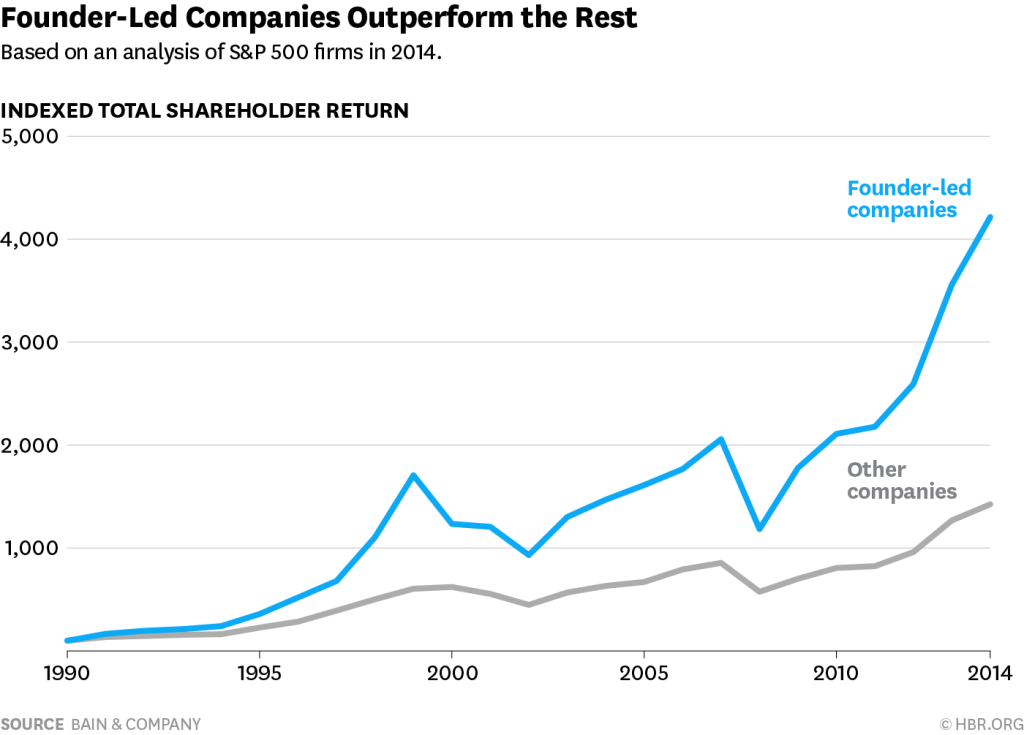

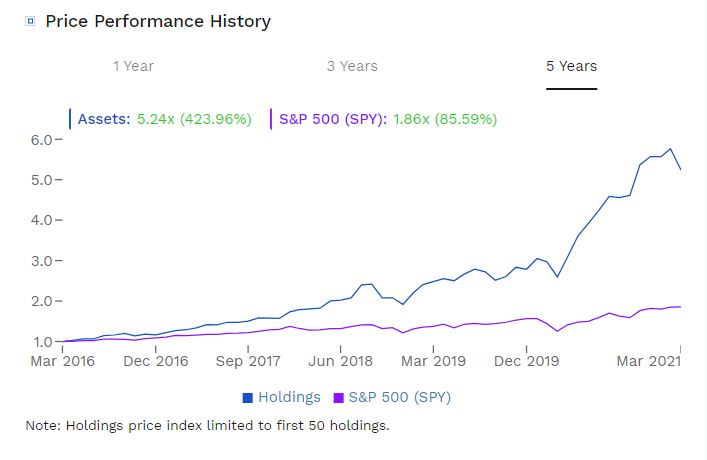

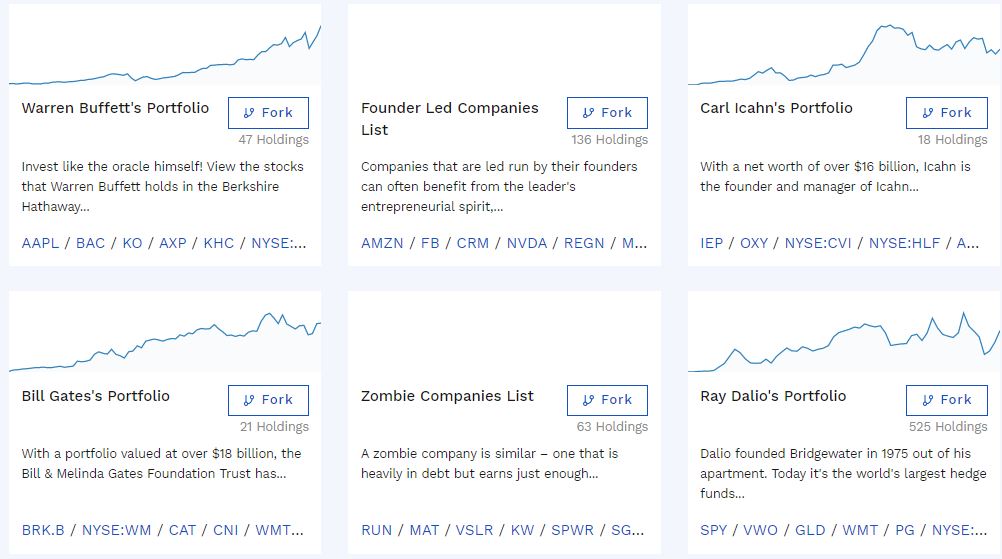

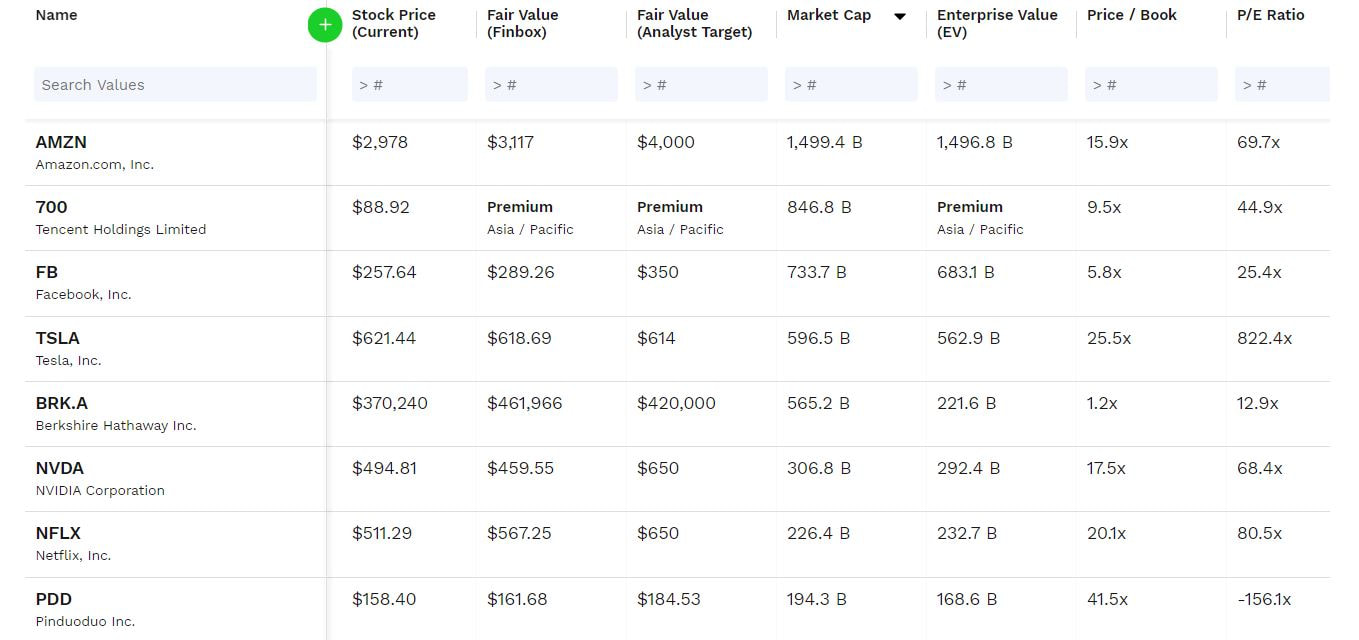

Here's why buying founder-led stocks can help you outperform the market over the long run. Unless you're an index investor, you probably want to beat the market, which is probably why you're reading this post right now. Here's an investing method that has been proven over the years to work and vastly outperform the S&P 500 index. Investing in Founder-Led StocksWhat is a founder-led company? Simply, it is a company that is being led by its founder. The founder should either be the CEO or another important role with a large enough stake in the company to have a say in its operations. Think companies like Tesla with Elon Musk, Amazon.com with Jeff Bezos and Facebook with Mark Zuckerberg. Companies like this tend to outperform the market. This article from Harvard Business Review, and the book "100 Baggers" by Christopher Mayer also mentions this. In this post, we'll explain why and show proof. In the Harvard Business Review article, it says: "Founders have the moral authority to make the hard choices, they know the detail of the business and have better instincts, and they have a long-term perspective on investments and building a company that lasts." Then, it talks about how founder-led companies are more innovative and quicker to act. Companies that don't innovate end up losing market share or potentially failing so this is obviously important. In short, according to the article referenced above, founders have an owners mindset, a front-line obsession, and often have a special/unique feature or capability that can give a business a sense of purpose (they call it business insurgency) which trickles down to employees. An owner's mindset usually results in less complacency, quicker decision making, and more risk taking (in a good way). A front-line obsession helps the founder be more in touch with what is happening in the business, rather than just being stuck in an office all the time away from the reality of the business. Lastly, when employees also have a sense of purpose due to business insurgency, they are more likely to be engaged in their work. This is a clearly a good thing. If the company isn't founder led, but has a CEO or management team that is heavily invested in the stock, then that is good too. When the management team owns a lot of shares, that generally means they truly believe in the stock, and will act in the best interest of long-term shareholders. But in this case, we'll talk only about founder-led stocks. A quick way to look at the details of a company's insider ownership is to use Simplywall.st (it's free). All you have to do is search for a company, and scroll down near the bottom to find ownership breakdown. Below is an example of the top shareholders in TSLA stock. As you can see, Elon Musk, who is the co-founder of Tesla, owns almost 18% of the stock ($106B). This gives Musk a huge incentive to put lots of effort/innovation into Tesla. Historical OutperformanceA study done a few years ago by Bain & Company found that an index of S&P 500 companies with founder-led companies outperformed other companies by a wide margin as you can see below. This study ends in 2014 though, so let's take some extra data from Finbox and use current numbers. Check out the picture below. Using 5 years' of data starting in March 2016, this founder-led index made by Finbox has returns of about 424% vs. about 85.5% for the S&P 500 (SPY). So there you have it, two different charts showing the proof of this concept over several decades. Now you might be asking, what are the companies in the list? How can I find them? Let's answer that. The Easiest Way to Find These StocksFinbox has an "ideas" section where there are hundreds of portfolio ideas you can take an in-depth look at. Here's an example of just 6 of them, with Founder-Led Companies being the second one. You can see the holdings in whichever portfolio you choose and sort them by your preferred metrics. Here's a snippet of the founder-led portfolio. The full list is 136 stocks which includes relatively unknown stocks under $1B market cap. If you're convinced that founder-led companies are for you, then screening for them in this fashion is the best way to get started. After making a list of founder-led stocks you want to check out, you could check out the rest of their fundamentals through Finbox as well and see the ownership breakdown of any stock you'd like using Simplywall.st as we showed before. Finbox currently doesn't have insider ownership breakdown which is why you need to use Simplywall.st (or other sites) for that right now, however, we spoke to Finbox and they said they will have this function later in 2021. ConclusionSimply put, founder-led stocks outperform the market for several reasons. This has been tested over the years and we have found the charts to prove it. The more the founder is involved in the business, the better. Elon Musk's nearly 18% ownership is very ideal. Sometimes founders own only 1% or less and they may still outperform, but it definitely isn't as convincing as 18%. High founder ownership combined with high insider ownership of other key members (CFO's, board members etc.) should yield even better results as you can be assured that it is in the key members' best interests to succeed. Screening for a good stock shouldn't stop there though. Don't just blindly buy a company because it is founder led! The company needs to be of high-quality and have a reasonable valuation. This will almost guarantee exceptional returns over the long run. Here's a checklist of things you can look for to find quality stocks to invest in. Recommended Tool For InvestorsFor fundamental analysis, we recommend using Finbox. It gives you access to accurate, up-to-date information on any stock in the world with over 900 million data points and 1000+ metrics to choose from. It also provides advanced stock screeners, investment ideas, and more. We don't want to sound like fanboys or annoying affiliate marketers, but we truly use Finbox every day. You saw how easy it was to find founder-led stocks with it. It makes all other kinds of fundamental analysis just as easy! Learn more here Thanks for reading! If you enjoyed this article, please consider following us on twitter @StockBrosTrades and/or subscribing to our free newsletter to get articles like this sent to you when they are posted! Related CategoryRelated Articles |

Categories

All

Archives

September 2022

|

RSS Feed

RSS Feed